Significant changes are taking shape at the Consumer Financial Protection Bureau (CFPB), particularly with recent directives for employees to shift to remote work. A memo from the bureau’s Chief Operating Officer, Adam Martinez, revealed that the agency’s Washington D.C. offices will remain closed until mid-February. This move follows an earlier communication from acting CFPB director Russell Vought, who suspended nearly all activities at the agency, including supervision over financial institutions. This abrupt transition has many questioning the effectiveness and stability of the CFPB under new leadership.

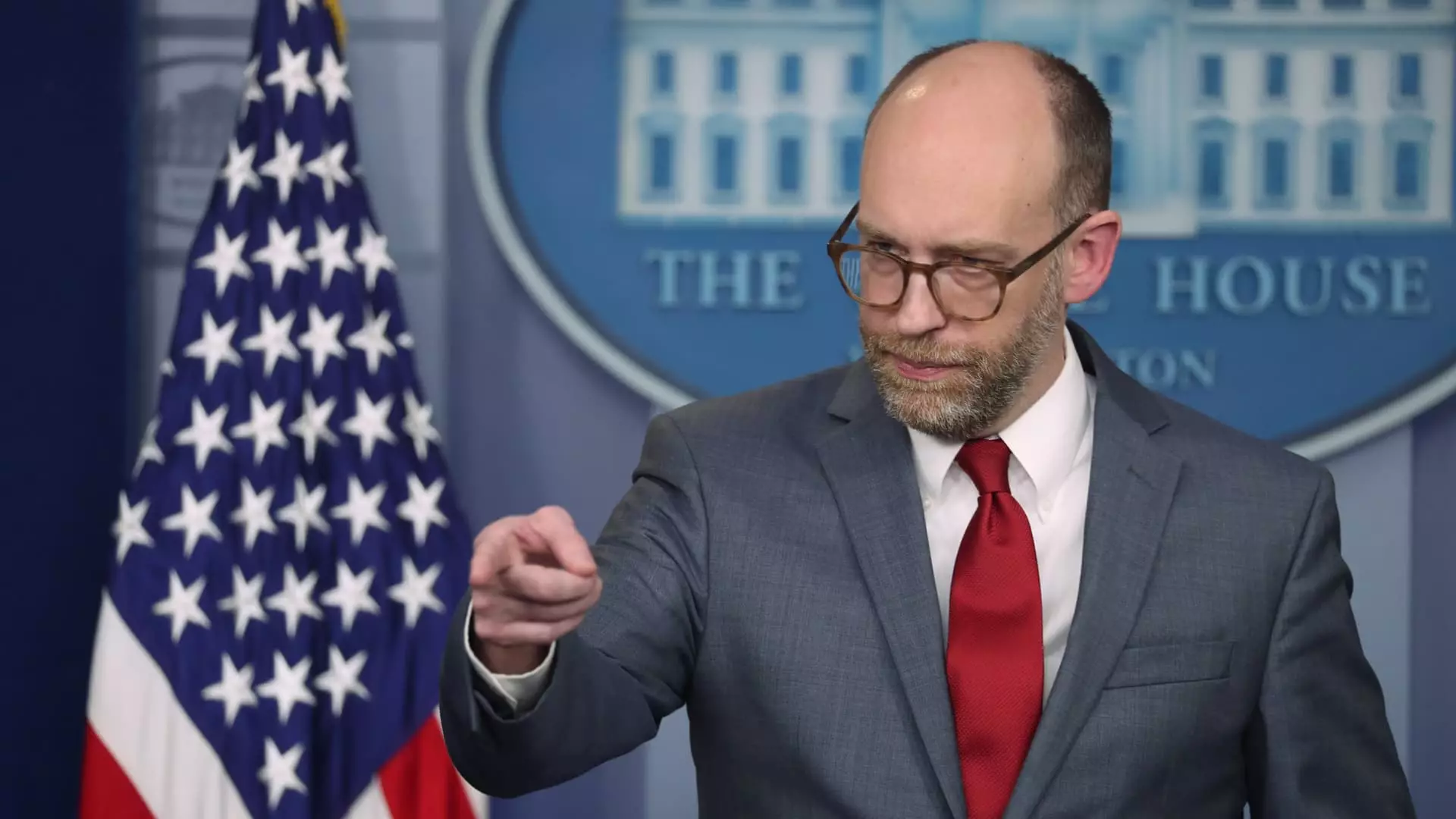

Russell Vought’s entry into the CFPB comes with a controversial backdrop, given his history and the administration he represents. Confirmed as the head of the Office of Management and Budget just days earlier, Vought wasted no time in implementing major policy changes, including halting new funding for the CFPB. His statements, particularly about curtailing financial inflow to the agency that has long been criticized for perceived unaccountability, underscore a significant move toward reengineering how the CFPB operates. The future of the CFPB hangs in the balance as these new measures take effect.

The appointment of Vought has raised eyebrows across the financial industry, especially since it coincides with reports of staff disruptions fueled by outside influence. Employees from Elon Musk’s DOGE have reportedly been given access to sensitive CFPB data, including internal performance reviews. This arrangement has alarmed many within the agency, as wielding external corporate power over a federal regulatory body poses inherent risks to independence and integrity. There are growing fears that the CFPB could be rendered ineffective, an idea notably hinted at by Musk himself when he provocatively declared “CFPB RIP” on his social media platform.

With operations in disarray and critical oversight halted, the CFPB’s role as a regulatory body is jeopardized. The consumer watchdog agency was initially established to protect consumers from unfair financial practices; however, its current trajectory under Vought raises questions about its capability to fulfill this mission. Without adequate funding and with significant portions of its staff inactive, concerns grow regarding its resilience and effectiveness in monitoring financial entities. The leadership challenges and uncertainties present a complex scenario that could impact the financial ecosystem as a whole.

As the CFPB navigates this tumultuous period marked by leadership upheaval and operational freeze, transparency and communication with stakeholders will be critical. The agency’s future will largely depend on how Vought and his team manage to restore stability and purpose while maintaining the essential functions of consumer protection. Stakeholders and the consumers they serve must remain vigilant as they await clarity and the potential repercussions of these dramatic changes in governance. In an era marked by uncertainty, the CFPB must redefine its objectives and reaffirm its commitment to protecting the American consumer.

Leave a Reply