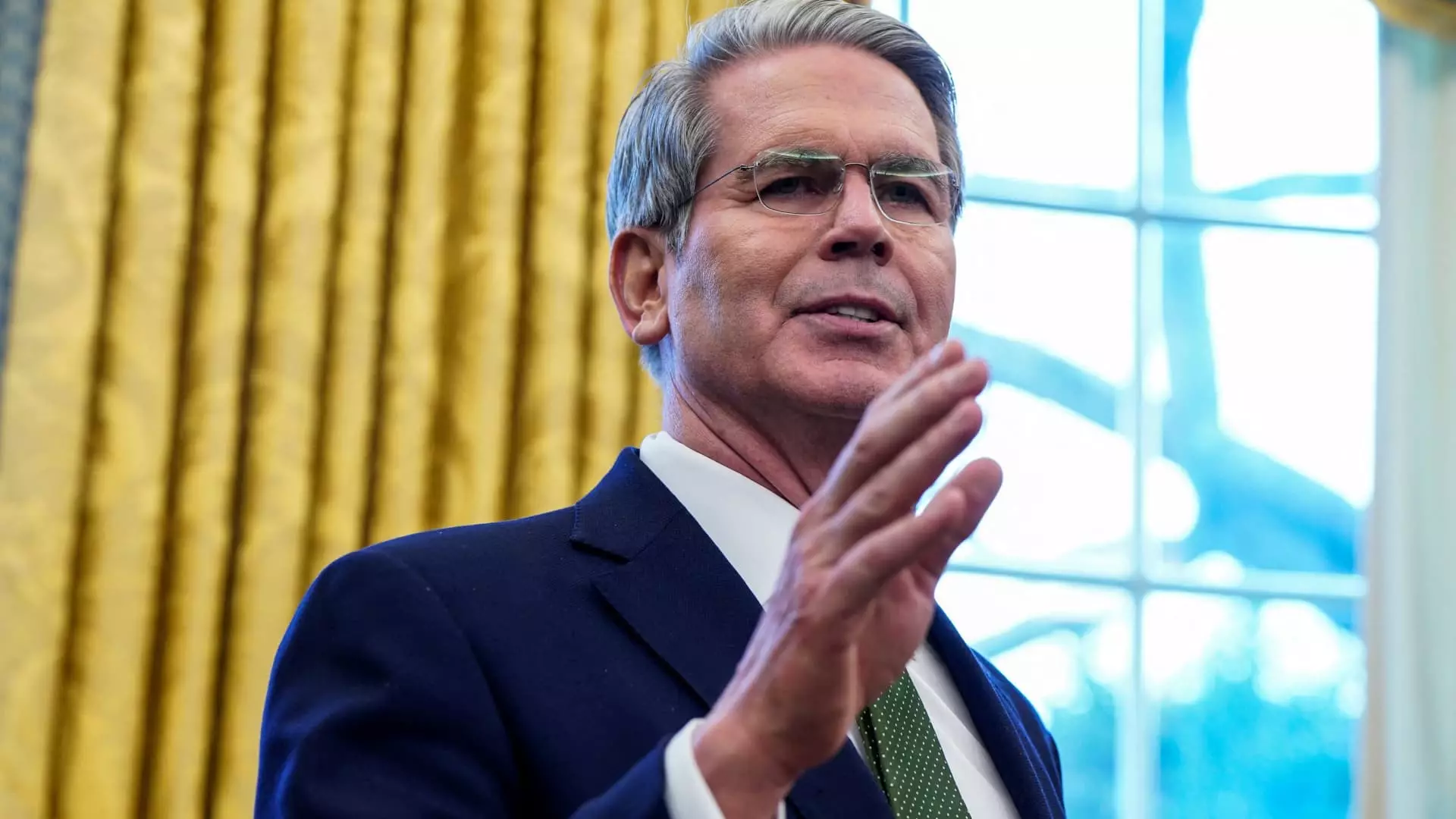

The financial landscape of the United States is often dictated by the actions of the Federal Reserve, but the Trump administration has taken a different stance. Recently, Treasury Secretary Scott Bessent articulated that the administration is prioritizing keeping Treasury yields low over direct influence from the Federal Reserve. This article delves into this strategic pivot, its implications, and how it contrasts with traditional economic policy frameworks.

The Trump administration’s fiscal strategy has notably shifted away from its previous calls for the Federal Reserve to adjust interest rates. Instead, Bessent emphasizes the use of fiscal policy—particularly focusing on the 10-year Treasury yield as a key benchmark. This is a significant divergence from the commonly scrutinized federal funds rate, which typically serves as a barometer for various lending rates throughout the economy, including mortgages, auto loans, and credit card interest.

By concentrating on the yield of 10-year Treasuries, the administration aims to create an economic environment where lower interest rates facilitate borrowing and investment. Bessent’s comments during a Fox Business interview suggest that President Trump is not inclined toward pressuring the Fed in the way he did in his first term. Instead, the administration believes in a more organic approach to lowering rates through deregulation and energizing the economy through tax reforms.

The Fed engaged in a rate-cutting cycle beginning in September 2024, reducing the funds rate by a notable one percentage point. While this action typically aims to stimulate economic growth, it had an unexpected outcome: Treasury yields actually rose, raising inflationary expectations. This situation highlights the complexity of economic interdependencies and the potential unpredictability of monetary policy impacts.

Despite these fluctuations, the Trump administration remains committed to its fiscal policy approach. Bessent’s assertion that the 10-year Treasury yield needs to be managed reflects deep-seated concerns over reaching critical economic thresholds, such as the 5 percent yield mark, which could lead to detrimental impacts on equity markets and housing prices. The administration’s avoidance of direct confrontation with the Fed is designed to cultivate a more stable economic environment while nurturing investor confidence.

One of the prominent aims of the Trump administration is the permanence of the Tax Cuts and Jobs Act, aimed at invigorating economic growth. Bessent underscores the necessity of limiting government expenditure and inefficiencies, suggesting that such measures would contribute to a favorable interest rate climate. The broader strategy includes reducing the national deficit and encouraging energy exploration, which the administration views as vital to achieving sustainable economic progress.

Krishna Guha from Evercore ISI posits that the administration’s focus on the 10-year yield essentially defines the limits of what “Trumponomics” can sustain. As the yield recently hovered around 4.45%, down from a peak of 4.8% in mid-January, the question arises about how sustainable this strategy is long-term and whether it can truly counteract wider economic forces.

As the Trump administration endeavors to shape economic policy through a distinct lens focused on Treasury yields, it raises important questions regarding the interaction between fiscal governance and traditional monetary policy. By distancing itself from the Fed and promoting measures aimed at economic deregulation and efficiency, the administration faces the challenge of maintaining market stability while attempting to navigate the unpredictable tides of the economy.

This departure from historical norms—the dynamic between the Fed and Treasury—could usher in a new paradigm for economic policy in the U.S. As Bessent aptly noted, the administration remains steadfast in its mission to support lower rates, positing that if the right economic conditions are cultivated, interest rates will align with the administration’s objectives. In this intricate dance of policies, the efficacy and foresight of their approach will remain a subject of significant scrutiny going forward.

Leave a Reply