Political betting has gained momentum as a unique avenue for gauging candidate viability, with platforms like Polymarket providing a window into the perceived odds of political outcomes. Recently, the platform has attracted attention due to significant financial maneuvers surrounding former President Donald Trump’s 2024 presidential campaign. Through a combined analysis of the behavior exhibited on the platform, the nature of prediction markets, and their impact on the political landscape, we can observe how these betting practices reflect broader societal trends and attitudes toward politics.

In a noteworthy turn of events, a single trader operating multiple accounts has made waves by wagering over $28 million on Trump’s electoral prospects. This has raised eyebrows among analysts and market observers, who wonder if this movement represents a solid conviction in Trump’s chances or if it reflects possible market manipulation. The revelation that all four accounts—Fredi9999, Theo4, PrincessCaro, and Michie—are interlinked suggests an organized strategy rather than isolated bets. This reconsideration of how money flows through betting markets could have profound implications for how political events are forecasted and understood.

Furthermore, the trader, identified as a French national with an extensive background in finance, has reportedly sourced his funds from a well-known centralized exchange, Kraken. This connection highlights how modern crypto dynamics intertwine with traditional financial standings, posing critical questions about regulatory standards in markets that thrive on speculation concerning future political events.

The juxtaposition of political betting markets and traditional polling methodologies is pivotal in understanding their respective roles in the democratic process. While opinion polls aim to capture the zeitgeist of voter sentiment, prediction markets like Polymarket quantify the financial backing for specific outcomes, effectively translating the perceived likelihood of events into dollar signs. As such, there’s validity in asserting that gamblers may have different incentives and insights compared to poll respondents, leading to a dissonance in the data trends observed.

Elon Musk, a prominent figure in the political arena and a supporter of Trump’s campaign, has publicly advocated for the accuracy of betting markets over polls. His proclamation that “actual money is on the line” insinuates that financial stakes can sometimes offer a more realistic depiction of future occurrences than surveys that gauge intent but may not fully account for logistical and psychological barriers to voting. However, this assertion has been met with skepticism, emphasizing that prediction markets and polling serve fundamentally different purposes. As Polymarket indicated, betting odds reflect probabilities rather than voter intention, highlighting the potential for misinterpretation.

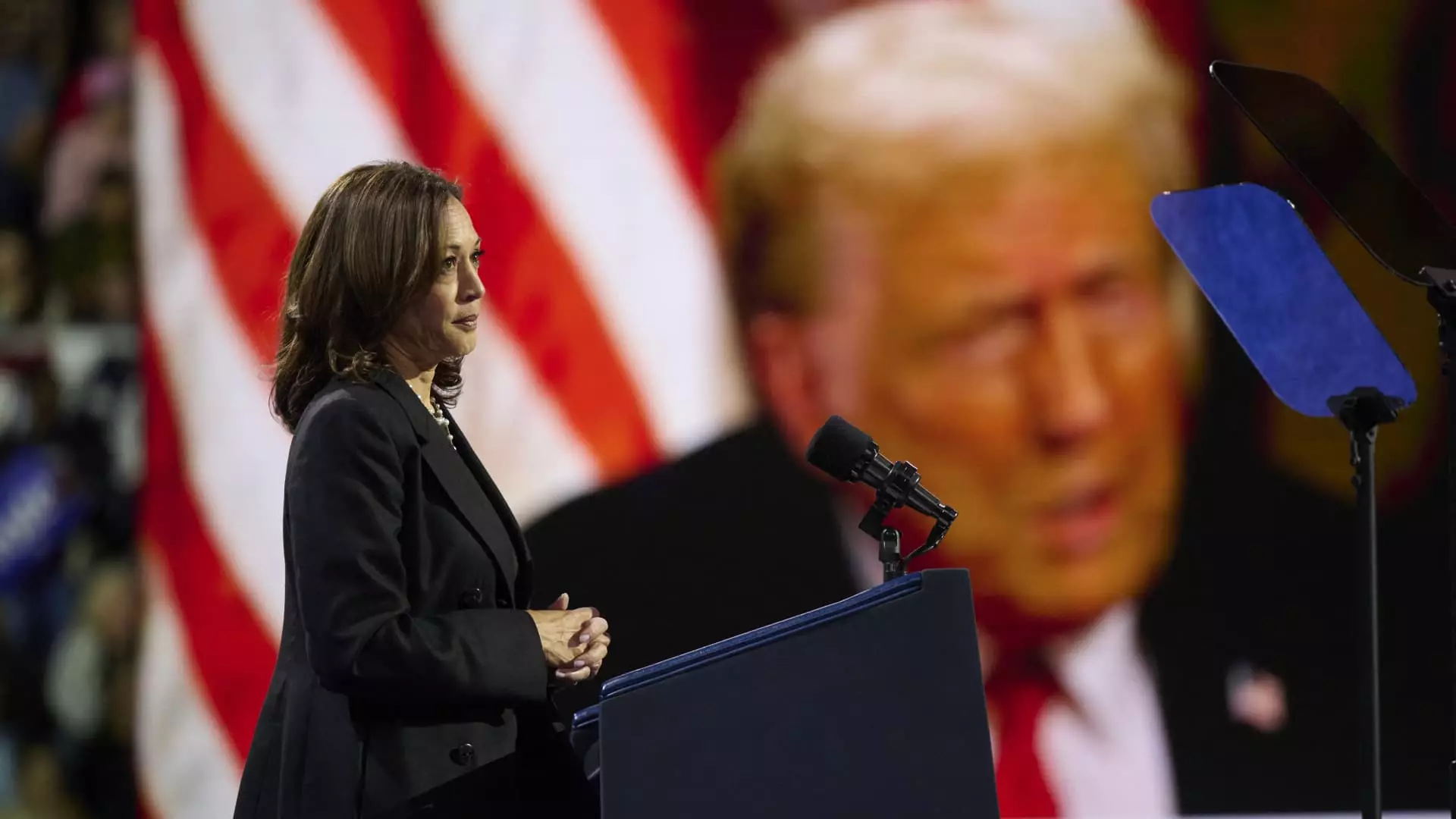

The dominance of this single trader’s accounts on Polymarket as one of the major forces backing Trump brings forth concerns about market integrity. Although Polymarket maintains that no manipulation has been found after extensive investigations, the mere existence of a whale trader raises doubts about the authenticity of market signals. The actions of this individual could create a misleading narrative surrounding Trump’s popularity, particularly if these bets disproportionately influence the futures market sentiment around the election.

Moreover, Polymarket is currently banned for U.S. traders following a previous settlement with the Commodity Futures Trading Commission (CFTC). This regulatory framework underscores the ongoing tension between novelty in financial markets and the need for governance. Other platforms like Kalshi are emerging, albeit under scrutiny themselves, showcasing the growing interest in political betting despite potential risks.

As we move closer to the crucial 2024 election, the implications of large-scale betting activities on platforms like Polymarket will undoubtedly be at the forefront of political discourse. The influence of financial stakeholders in shaping perceptions about candidate viability raises ethical and practical questions. With their growing prominence, the confluence of politics and financial speculation demands careful scrutiny to ensure that the integrity of electoral processes is preserved.

In a society increasingly guid ed by data and financial incentive, understanding how these elements interact may be pivotal in navigating the nuanced landscape of contemporary politics. Thus, while political betting offers a new lens through which to assess electoral outcomes, it simultaneously underscores the importance of maintaining a critical eye on the interplay between finance, perception, and reality in the democratic sphere.

Leave a Reply