In an era characterized by economic unpredictability, Berkshire Hathaway has emerged as a standout player, defying the sweeping downturn engulfing the stock market. Investors, spooked by a turbulent week underscored by President Donald Trump’s aggressive tariff policies, have instinctively gravitated towards the safety offered by Warren Buffett’s cash-rich conglomerate. This phenomenon is not merely a testament to Buffett’s venerable reputation but also illustrates a critical divergence in the perceptions of market stability and risk during times of uncertainty.

Despite facing a 6.2% decline in Class B shares over the last week, Berkshire Hathaway’s performance distinctly outpaced the broader market indices—most notably, the S&P 500, which plunged 9.1%. It is noteworthy that, amid this shake-up, Berkshire not only protected its ground but also maintained an overall increase of approximately 8% this year. Such resilience is indicative of a company that has successfully aligned its strategic portfolio to weather economic storms and sustain investor confidence.

Berkshire’s Defensive Nature: A Shield Against Market Capsizing

A crucial factor in Berkshire’s relative success compared to its peers rests in its unique business model. With a diverse portfolio that encompasses significant holdings in insurance, energy, manufacturing, and retail, Berkshire operates as a multifaceted defensive shield against the vagaries of market sentiment and economic policy changes. This is exemplified by its extraordinary liquidity—boasting a staggering $334 billion in cash reserves, Berkshire provides prospective investors with a refuge that is hard to replicate in today’s volatile market.

Ritholtz Wealth Management CEO Josh Brown aptly noted that Berkshire is strikingly insulated from the capriciousness of political machinations. The perception that certain companies can survive without being tethered to the whims of political agendas has resonated with investors looking for stability in uncertain times. Berkshire, with its broad exposure to the U.S. economy, stands as a reassuring beacon in an otherwise turbulent sea of shifting trade policies and economic uncertainty.

The Evolving Investor Sentiment and Market Dynamics

Investor sentiment has undeniably shifted towards a favoring of stocks that exemplify resilience and stability. The stark reality is that many high-flying tech stocks have proven to be fragile, vulnerable to regulatory scrutiny and market corrections, thereby reinforcing the appeal of conglomerates like Berkshire Hathaway. As the S&P encounters a steep downturn, it is evident that the market is conducting a decisive sorting process—distinguishing robust entities from those reliant on favorable political winds.

Moreover, Berkshire’s ability to stay above its crucial 200-day moving average, a widely used momentum indicator, further solidifies its standing. It’s a rare feat among the top ten companies listed on the S&P 500. Such technical strength can signal investor confidence, suggesting that there are still stocks capable of achieving steady growth regardless of market turmoil. This era demands a keen eye for value and substance, and Berkshire’s performance stands as evidence of that essential investment principle.

Berkshire Hathaway: More Than Just Numbers

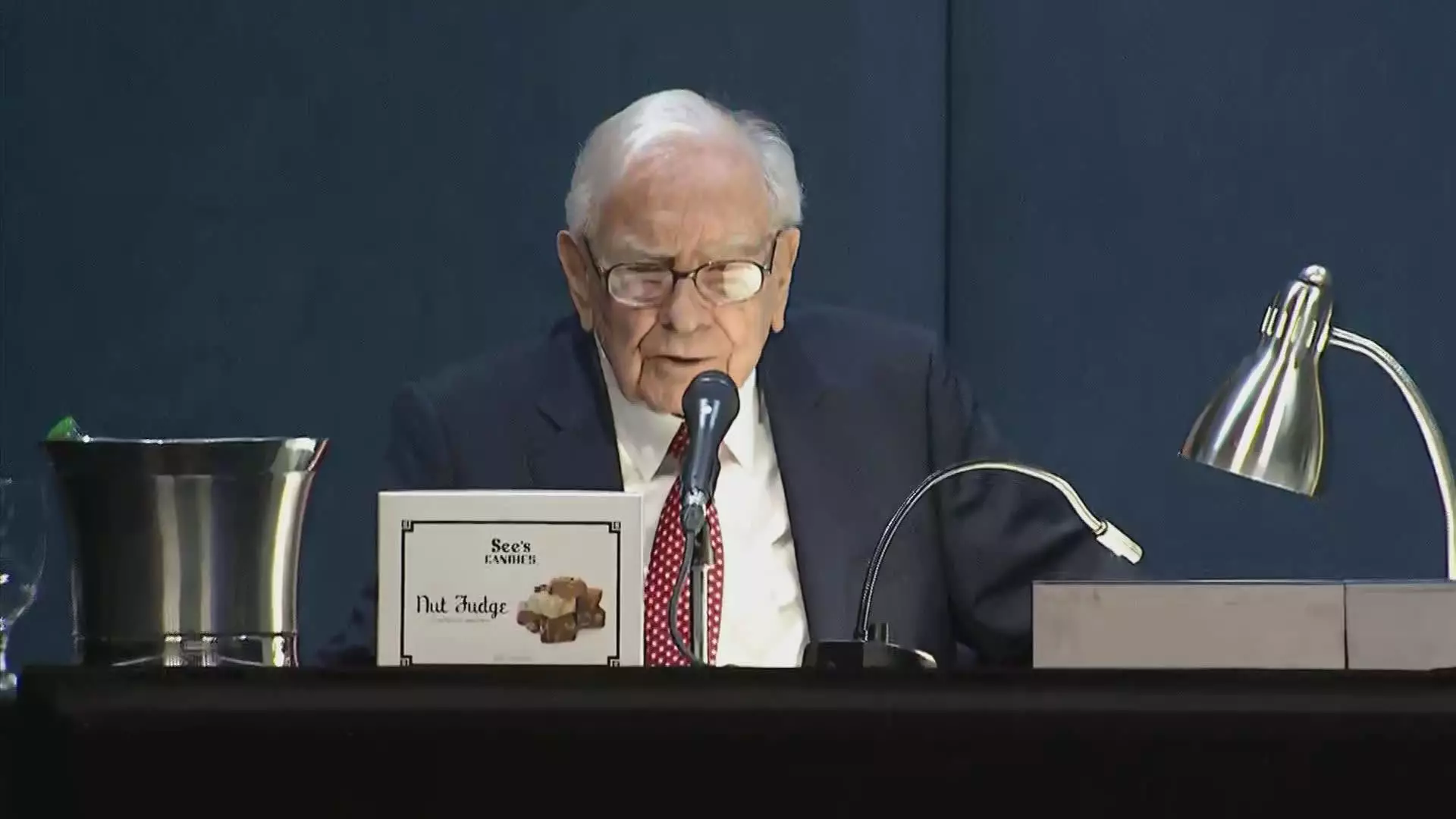

However, beyond the financial metrics and market indicators lies a complex psychological landscape. The long-standing admiration for Warren Buffett and his investment philosophy creates a compelling narrative, one that intertwines emotional and rational decision-making. Despite the social media whirlwind ignited by Trump, linking Buffett to trading maneuvers, the legendary investor manages to disentangle himself from such sensationalism, reaffirming the integrity and independence of his investment judgments.

While the markets react anxiously to policy uncertainties—especially under a president known for his impulsive decisions—Berkshire stands tall as a testament to a more stable approach to business. It is this steadfastness that captivates and retains a loyal investor base. As we navigate through ongoing economic repercussions, Buffett’s approach reaffirms that strategic patience and a well-rounded portfolio can indeed withstand external pressures.

As we reflect on the current state of the market, it becomes increasingly evident that companies like Berkshire Hathaway are not merely survivors; they are exemplars of resilience in the face of disruption. This combination of robust financials, strategic industry exposure, and a solid foundation of trust positions Berkshire not just as a refuge for wary investors, but as a pioneering force within modern finance.

Leave a Reply