In a landmark case that highlights the growing intersection of technology and crime, Ilya Lichtenstein has been sentenced to five years in prison following his involvement in one of the largest cryptocurrency thefts to date. The 2016 hack of Bitfinex, a prominent cryptocurrency exchange, resulted in a loss of nearly 120,000 bitcoin, which at that time was valued at around $70 million. However, the dramatic appreciation of bitcoin over the years has escalated the stolen cryptocurrency’s worth to an astounding $10.5 billion today. This case serves as a stark reminder of the potential ramifications of engaging in cybercrime, not only for individuals but also for the broader digital economy.

Lichtenstein’s methodical approach to the hack was marked by more than 2,000 unauthorized transactions, which underscored his technical prowess in navigating the intricacies of cryptocurrency networks. It wasn’t merely a simple theft; prosecutors described his laundering techniques as some of the most complicated strategies encountered in the federal system. This reflects a trend in digital crime where perpetrators become increasingly sophisticated in disguising their illicit activities. Indeed, Lichtenstein managed to encode his operations in a manner that evaded detection for several years, demonstrating the evolving landscape of cybercrime and the need for enhanced regulatory measures.

The Admission of Guilt and Sentencing Details

During his plea hearing in August 2023, Lichtenstein publicly acknowledged his role in the cyberattack for the first time. This admission marked a significant turning point, as it not only clarified his position in the case but also contributed to the overall narrative regarding accountability in the context of digital crime. U.S. District Judge Colleen Kollar-Kotelly, who oversaw the proceedings, commented on the gravity of Lichtenstein’s actions, which prosecutors described as an unprecedented breach of trust within the virtual currency sphere. While Lichtenstein faced a potential maximum sentence of 20 years, the five-year term he received — in addition to three years of supervised release — reflects a judicial understanding that while the crime was severe, he is also potentially capable of reform.

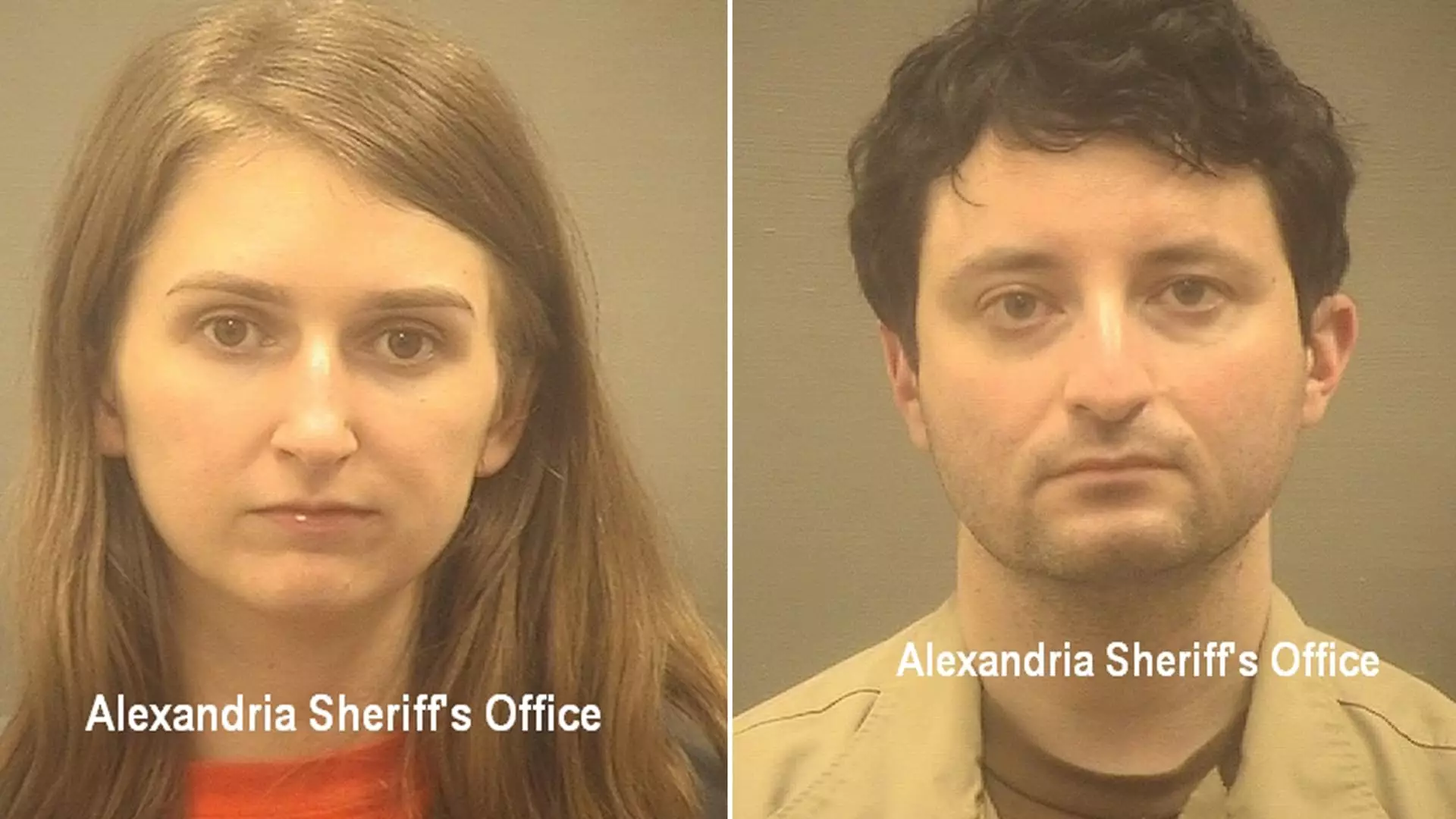

Lichtenstein’s wife, Heather Rhiannon Morgan, also found herself entangled in this high-profile case, as she pleaded guilty to a conspiracy charge related to money laundering. The government characterized her involvement as that of a lower-level participant and requested an 18-month prison sentence for her. This distinction elucidates the myriad roles people can play in financial crimes, with some acting as primary offenders while others may merely act as facilitators or accomplices. Morgan’s upcoming sentencing will further delineate the complex fabric of accountability, complicating perceptions of culpability in such extensive operations.

Seized Assets and Future Implications

Following the couple’s arrest in February 2022, authorities seized over 94,000 bitcoin connected to the hack, valued at more than $3.6 billion at the time. This figure has since increased, with the current valuation approaching $8.3 billion. The Department of Justice has indicated its intent to return these assets to Bitfinex and potentially other victims, a process that underscores the legal system’s commitment to restitution in financial crimes. This scenario raises pressing discussions about asset recovery, digital asset ownership, and the broader implications for the cryptocurrency market.

Sentencing as a Deterrent

Lichtenstein’s sentencing not only reflects the gravity of his actions but also stands as a warning to potential cyber offenders. The consequences of such cybercrimes extend well beyond the individuals involved; they affect a broader digital ecosystem, causing significant financial disruption and undermining public trust in emerging technologies. As cryptocurrency continues to evolve and grow, the legal ramifications for those who engage in similar criminal behavior will likely become more severe, paving the way for stricter regulations and enforcement.

The sentencing of Ilya Lichtenstein serves as a critical focal point in the larger discussion surrounding cybersecurity, digital currencies, and the ethical implications of rapid technological advances. This case is not just about individual accountability; it reflects urgent calls for enhanced measures to ensure safety and integrity within the digital financial landscape.

Leave a Reply