In the volatile landscape of stock markets, few things inspire hope more than a slew of positive forecasts from reputable financial institutions. Recently, Bank of America highlighted an impressive list of companies considered ripe for investment, amplifying a sense of optimism. Stocks like Nvidia, Amazon, Netflix, and Boot Barn are not just making noise; they’re creating a symphony of promising indicators that suggest substantial growth potential. These insights invite investors to reflect not merely on current performance but on a broader picture—how these companies are strategically positioning themselves for a future that appears increasingly bright. It’s a moment that begs the question: Is there an underlying shift in the market that we should be paying attention to?

Streaming Success: Netflix Rides the Momentum Wave

Netflix continues to stand as a titan within the streaming sector, and Bank of America’s recent analysis only underscores its power. With a price target elevated dramatically from $1,175 to $1,490, one cannot help but marvel at the confidence analyst Jessica Reif Ehrlich expresses in her report. The growth trajectory seems sustained, buoyed by a mixture of increased earnings, a rising subscriber base, and even macroeconomic factors such as tariffs that indirectly support Netflix’s business. The firm’s exploration into advertising technology and live sports could be pivotal.

However, skepticism should take center stage here. Can Netflix maintain this dominance while navigating an increasingly competitive landscape filled with others vying for consumer eyeballs? While the potential for advertising and new content is appealing, the streaming giant must continuously innovate to fend off rivals. If Netflix is indeed “well positioned for growth,” it’s vital to remember that this is not just a game of chess; it’s a high-stakes poker match where the landscape can change in an instant.

The Robotics Revolution: Amazon on the Brink of Transformation

Amazon, a behemoth in e-commerce, is forecasting a future where robotics play a critical role in operational efficiency. With a revised price target moving from $230 to $248, analyst Justin Post is bullish on Amazon’s potential to optimize delivery processes and slashing dependence on labor while enhancing accuracy and warehouse efficiency. The integration of drones and automated systems has a promising allure, but the narrative doesn’t end there.

Though the signs are overwhelmingly positive, it’s crucial to ponder the broader societal implications of this tech-driven transformation. While enhancements in efficiency are essential, they come with ethical considerations—the displacement of jobs and the economic ramifications for communities that rely on these roles. As investors, are we primarily driven by numbers? Or do we have a social conscience that weighs the repercussions of our investments? Companies like Amazon must tread carefully; the growth narrative will inevitably be scrutinized against the backdrop of a workforce facing uncertainty.

Boot Barn: A Unique Growth Story

Bank of America’s spotlight on Boot Barn reveals a unique growth narrative, one that connects strongly with consumer sentiment and diverse merchandise sophistication. Analyst Christopher Nardone raising the price target from $173 to $192 signals a multi-year growth outlook underscored by positive trends across various markets. The Western-themed retailer capitalizes on an aura of tradition while promoting a modern retail approach.

Yet, the retail sector has been notoriously volatile, impacted by shifting consumer preferences and economic factors. While Boot Barn enjoys a solid competitive watershed, one cannot ignore the potential risks involved—does its branding resonate universally? The company must navigate these waters with finesse, ensuring that its charm does not become a hindrance to reaching broader markets. The charming facade of Western wear might appeal to a niche, but it must evolve to guarantee relevance.

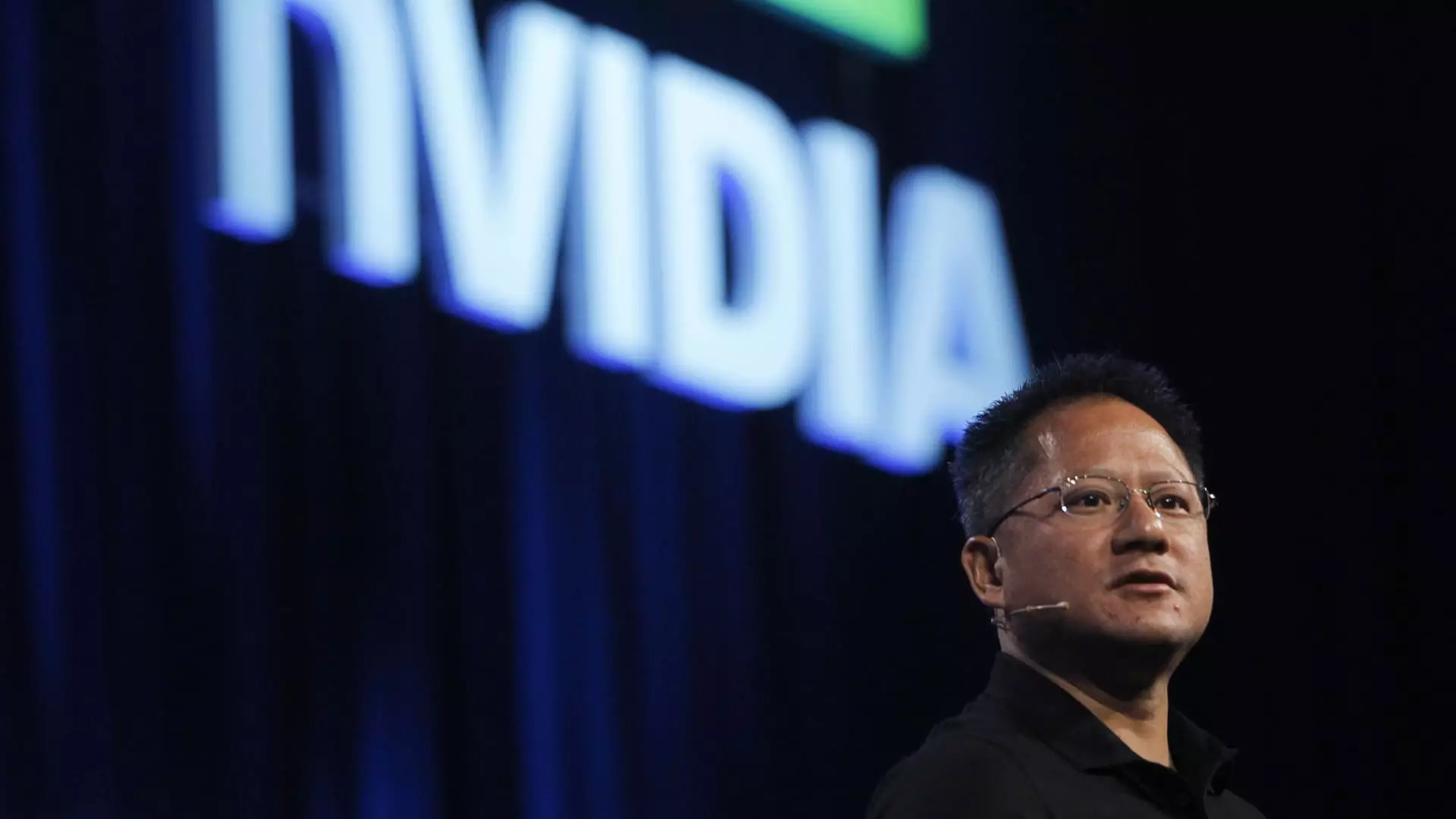

Nvidia: The AI Goldmine

Nvidia shines as an emblem of technology’s potential, especially in the growing realm of artificial intelligence. Maintaining a ‘Buy’ rating and elevating its price target, the firm shows a steadfast belief in Nvidia’s capacity to harness AI’s trajectory. The company’s dominance is rooted in a robust pipeline and strong developer support, giving it an edge that many analysts find difficult to overlook.

Still, skepticism lingers. The fervor surrounding AI could lead to inflated expectations, and navigating this hype will be crucial. If Nvidia does not deliver on its ambitious projections, the fallout could be severe, tarnishing its image and value proposition. Investors should remember that while excitement fuels the market, tempered optimism should always prevail.

In a market ripe with possibilities, investment choices require not just financial acuity but also a deep understanding of the ethical and societal implications of those choices. Each player’s role in the economy forms a narrative that transcends profit—one that speaks to our collective responsibility as investors, consumers, and advocates for positive change.

Leave a Reply