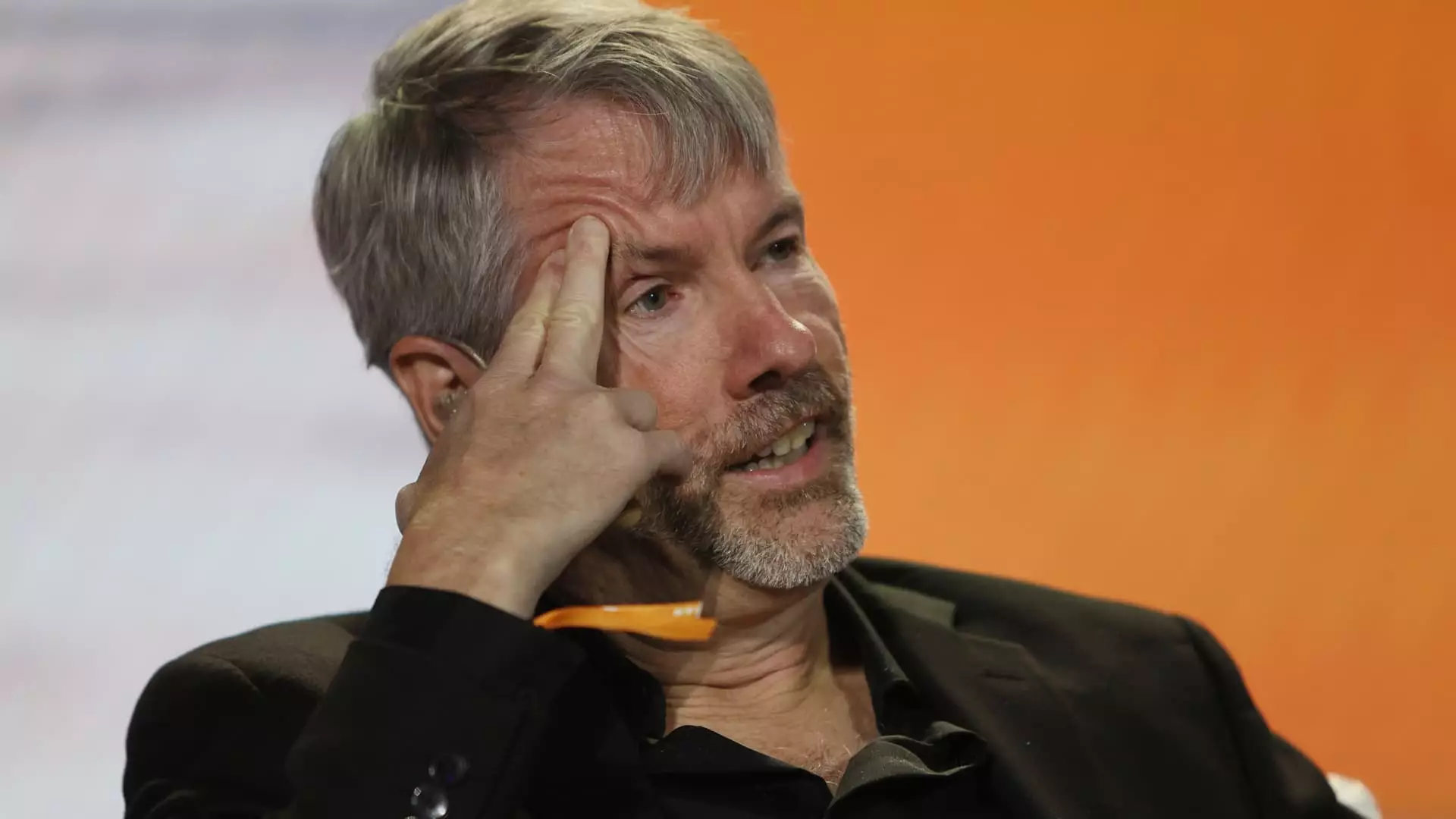

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has become synonymous with Bitcoin investment. He has transformed his company into a high-risk proxy for the cryptocurrency, advocating that tech giants like Microsoft should adopt a similar approach to safeguard their financial futures. Recently, Saylor presented a proposal at Microsoft’s annual shareholder meeting, urging the company to allocate some of its considerable cash reserves towards Bitcoin. However, the shareholders decisively rejected his initiative, raising questions about the future of tech companies navigating the volatile landscape of cryptocurrencies.

At the heart of Saylor’s argument is the staggering performance of Bitcoin compared to traditional assets. In a succinct three-minute presentation shared on X (formerly Twitter), Saylor cited data showing that Bitcoin yielded an annual return of 62% between August 2020 and November 2024, starkly outperforming Microsoft’s own returns of 18% and the S&P 500’s 14%. He contended that companies could enhance shareholder value by converting their cash reserves into Bitcoin, potentially adding hundreds of dollars to their stock prices.

Despite the allure of such projections and his insistence that “Microsoft can’t afford to miss the next technology wave,” the shareholders were not convinced. Saylor’s appeal was met with resistance, reflecting a complex relationship between traditional corporate management and the emerging cryptocurrency market. Microsoft has navigated these waters before; it began accepting cryptocurrency payments back in 2014 but has been cautious in fully committing to it as an asset.

Despite boasting a remarkable $78.4 billion in cash and equivalents as of September, Microsoft has decided to tread carefully. Following evaluations conducted by its treasury and investment services team, the company has chosen not to embrace Bitcoin fully, potentially missing out on the digital gold rush that has propelled MicroStrategy’s stock price upward by nearly 500% this year. Microsoft’s finance chief, Amy Hood, noted during the shareholder meeting that the company continues to monitor developments in crypto but emphasized that their current strategy does not involve significant exposure to it.

In light of Saylor’s persistent advocacy, including a direct social media appeal to CEO Satya Nadella, Microsoft’s shareholders remain skeptical. Proxy advisors Glass Lewis and Institutional Shareholder Services recommended a no vote on Saylor’s proposal, indicating a collective hesitation within the investment community about the feasibility of such a risk-laden strategy for one of the world’s most entrenched technology companies.

Saylor’s approach at MicroStrategy has been to embrace Bitcoin fully, with the company owning approximately 423,650 Bitcoins bought at an aggregate cost of around $26.5 billion. With Bitcoin trading around $95,000, these holdings are now valued at over $41.3 billion. This dramatic rise in value has positively impacted Saylor’s net worth, which soared to $9.1 billion. However, this aggressive strategy raises questions about sustainability; it has involved selling stock and leveraging debt to fund Bitcoin purchases.

While MicroStrategy’s gambit has paid off spectacularly in the short term, it hinges on the continued success of Bitcoin as a mainstream financial asset. Saylor’s vision exemplifies both the potential rewards and inherent risks of betting a company’s future on a single, volatile asset. As the cryptocurrency market remains prone to significant fluctuations, corporations contemplating similar strategies must weigh the implications carefully.

Saylor advocates for change, pushing large corporations to rethink their asset portfolios in light of rising inflation and economic uncertainties. Yet, he must also contend with a broader industry perspective that views cryptocurrencies with skepticism, particularly in traditional sectors like software and technology. Microsoft’s hesitance to shift its strategy underscores a critical debate about how well-established firms can adapt to disruptive innovations without jeopardizing their core operations.

As financial markets evolve and digital currencies continue to loom large over discussions of future assets, the divide between proponents like Saylor and cautious corporations like Microsoft will likely persist. The ongoing dialogue highlights the complexities of integrating new technologies within established business frameworks. For investors, stakeholders, and curious onlookers, the coming months will reveal whether Saylor’s vision for Bitcoin integration stands the test of time or serves as a cautionary tale for other companies considering a similar path.

Leave a Reply