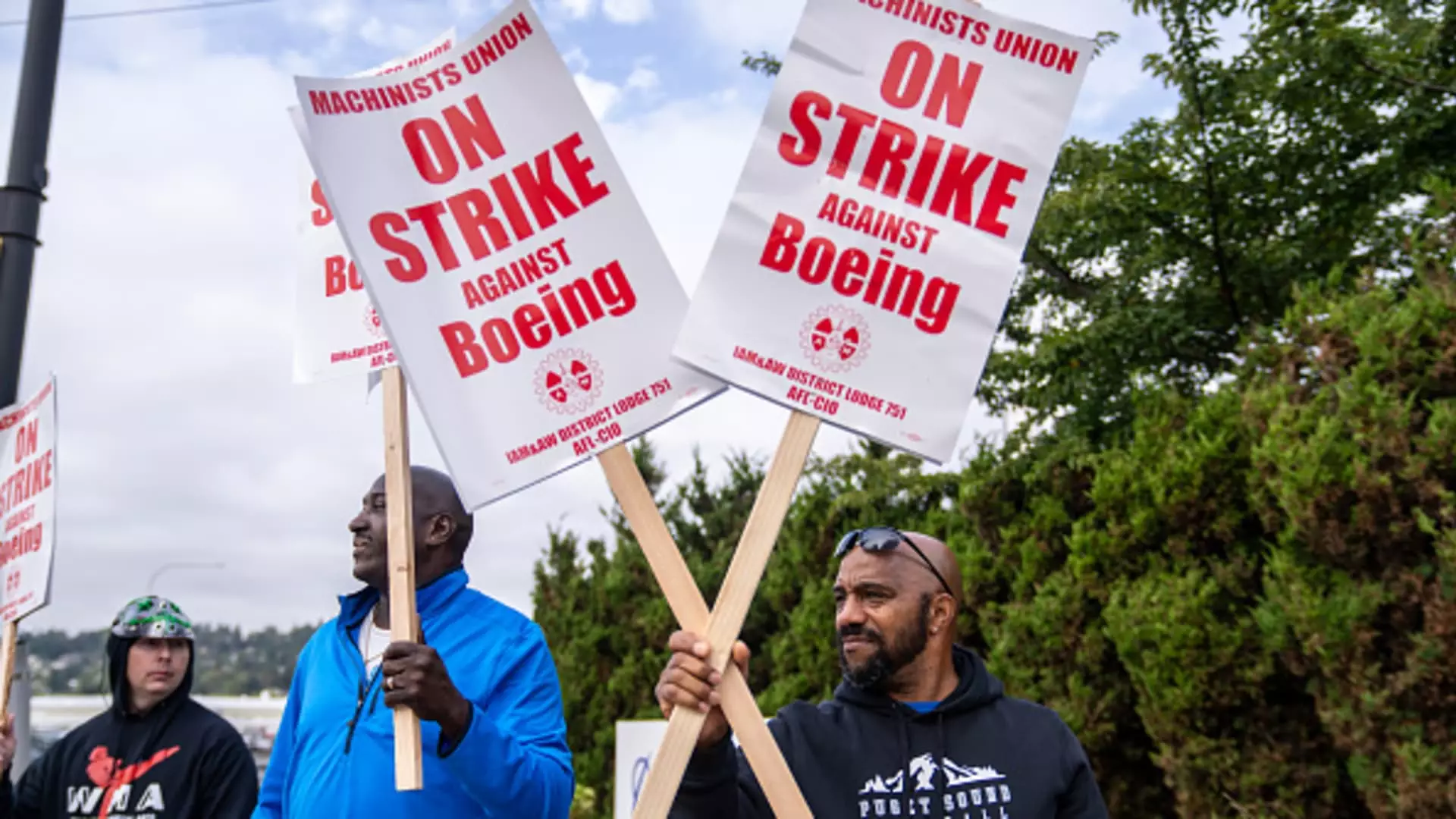

Over a month has passed since more than 30,000 Boeing machinists initiated a strike, following a resounding rejection of a tentative labor contract. This development has sent shockwaves throughout the aerospace giant as it grapples with rising costs and increasing tensions among its workforce. With new CEO Kelly Ortberg at the helm—who stepped into the role during a tumultuous summer—the stakes are high. The strike not only complicates immediate operations but also intensifies pressures on a company already facing numerous operational challenges.

The strike’s financial toll is staggering; estimates from S&P Global Ratings indicate that Boeing could be losing over $1 billion each month due to halted production. This unrest appears to be the crescendo of a tumultuous year, which began with serious operational missteps, including a perilous blowout of a 737 Max door plug. For Boeing, the strike has revived haunting memories of its recent past, including two fatal crashes involving the 737 MAX model that plunged the firm into a prolonged crisis.

As the strike continues, Boeing and the International Association of Machinists and Aerospace Workers (IAM) find themselves at a frustrating impasse. Notably, last week, Boeing withdrew a revised contract offer, arguing that it had not been sufficiently negotiated and thus lacked credibility. This situation paints a grim picture of Boeing’s internal negotiations, especially given that prior optimism from the company’s leadership about reaching a resolution had quickly dissipated.

The recent rejection of the tentative labor deal, which faced a staggering 95% disapproval from the workers, signals profound dissatisfaction among employees. Experts believe that Boeing will have to make significant concessions to the union if they hope to return to production lines soon. Harry Katz, a labor relations scholar, commented that the ongoing strike could extend from two to five weeks, compounding Boeing’s already precarious situation.

The negotiations between Boeing and the union have recently taken a more contentious turn. The company’s decision to file an unfair labor practice charge against IAM has only escalated tensions. Boeing accused union leaders of bad faith negotiations, presenting a narrative of disrespect that may further complicate future talks.

In contrast, the union’s president, Jon Holden, has urged a return to constructive dialogue, emphasizing that the striking workers want a resolution that reflects their demands. This reflects a significant transformation from historically combative labor relations, with union members expressing both frustration and hope for a change in approach from management.

While striking machinists currently face financial difficulties, the situation is somewhat mitigated by an abundance of contract work in the Seattle area. The ease of transitioning to alternative job sources such as food delivery and warehouse work may alleviate some immediate pressures. Nonetheless, a profound sense of insecurity looms due to the recent announcement that Boeing plans to slash its global workforce by approximately 10%, which includes laying off both managerial and operational staff.

Boeing’s financial prognosis appears bleak, with projections indicating a near $10 loss per share for the third quarter alone. The company’s struggle to maintain profitability—having not recorded an annual profit since 2018—has triggered an urgent need for strategic reevaluation. Ortberg, stepping into this challenging milieu, faces investors for his first earnings call on October 23, where investors will scrutinize his plans for reversing company fortunes.

Industry analysts are expressing mounting concern regarding the company’s declining stock value, which has dropped by over 42% this year—the steepest fall since the 2008 financial crisis. Richard Aboulafia, a prominent aerospace consultant, voiced doubts about Boeing’s future, stating that inefficiencies in their labor force are exacerbating production challenges and undermining the entire operational model.

Boeing now finds itself at a critical crossroads: to mend relations with its workforce while addressing pressing financial concerns. The company’s leadership has acknowledged the necessity of focusing on core competencies rather than diluting efforts across multiple operational fronts that have historically led to inefficiencies.

Amidst declining production figures and labor unrest, there is a pressing need for Boeing to regain stability—not only within its own operational framework but also across its extensive network of suppliers that rely on its performance. Instability at Boeing risks reverberation through the broader aerospace supply chain, threatening the viability of numerous partner organizations, including key component manufacturers.

In this period of uncertainty, the path forward for Boeing will be fraught with challenges as it seeks to reconcile varied interests: meeting union demands, regaining financial health, and restoring its place as a leader in the aerospace industry. As both sides prepare for what could be drawn-out negotiations, the urgency of finding common ground has never been clearer.

Leave a Reply