The ongoing saga of Nippon Steel’s controversial attempt to acquire U.S. Steel serves as a vivid illustration of the intricate interplay between international business, national security considerations, and political dynamics in the United States. In a significant development, the Biden administration has postponed the deadline for the companies to abandon their $14.9 billion bid until June 2025, thereby extending the window for a potential resolution that could reshape the landscape of the American steel industry.

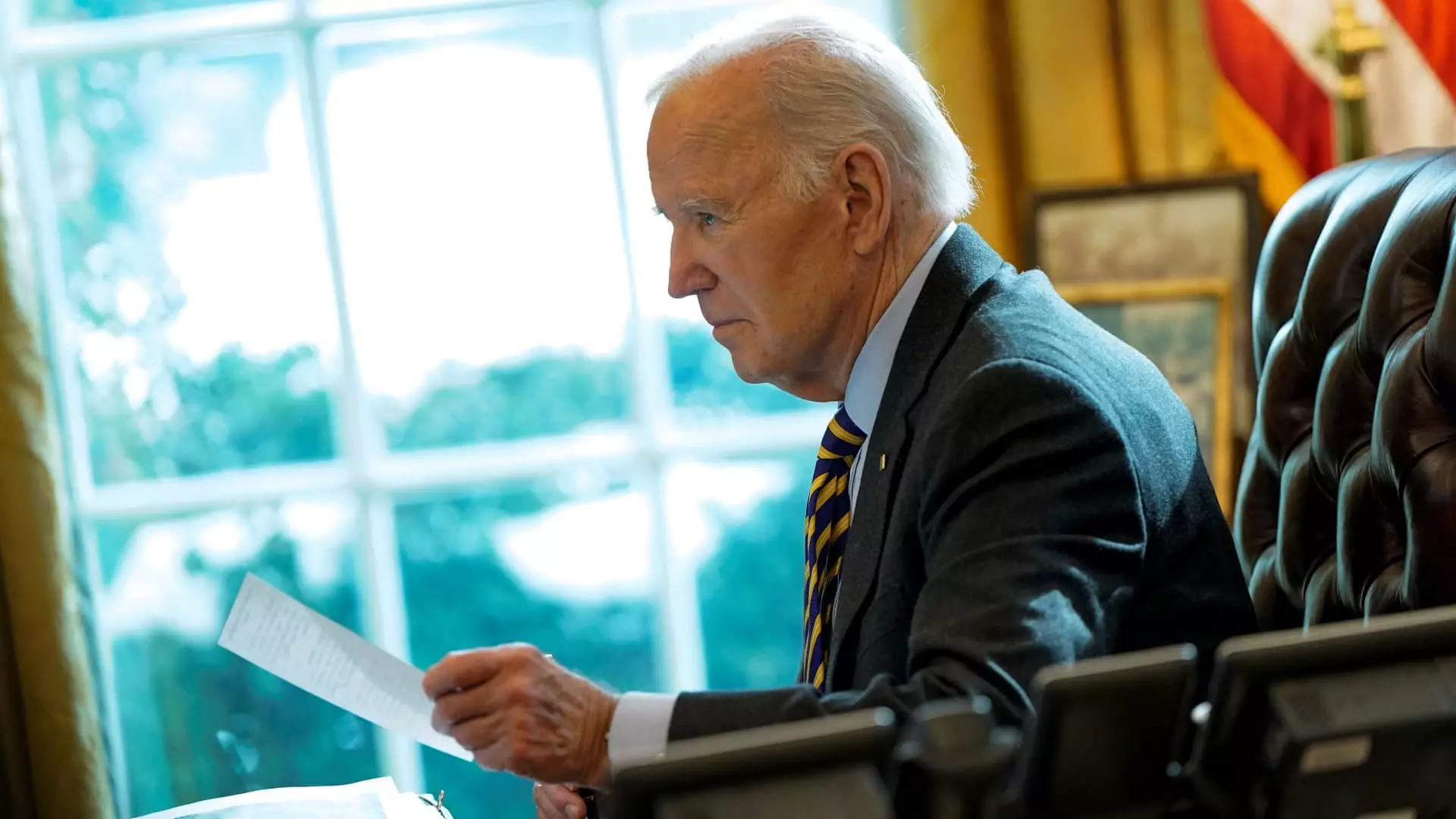

On January 3, President Biden invoked national security concerns to thwart the acquisition, a stance echoed by Treasury Secretary Janet Yellen, who indicated that the proposal underwent extensive scrutiny by the Committee on Foreign Investment in the United States (CFIUS). This interagency committee plays a critical role in assessing foreign investments that may pose security risks. The August deadline originally set for abandoning the deal has now been extended to June 18, 2025, providing the steelmakers the opportunity to navigate through legal challenges and possibly revive their ambitious merger plans.

This strategic delay raises pertinent questions about the balance between safeguarding national interests and fostering an environment that promotes foreign investment. The decision to allow the legal process to unfold implies a nuanced understanding of the complexities involved in foreign acquisitions, particularly regarding industries deemed crucial to economic security, such as steel production.

Notably, both President Biden and former President Donald Trump publicly opposed Nippon Steel’s bid during the electoral campaign, responding to the sentiments of American labor unions which expressed significant apprehension regarding foreign ownership in critical manufacturing sectors. The United Steelworkers union has been particularly vocal against the merger, emphasizing the potential risks to domestic jobs while highlighting broader concerns about American industrial sovereignty.

The lawsuit filed by U.S. Steel and Nippon Steel, which claims bias from the CFIUS review rooted in Biden’s longstanding resistance to the acquisition, underscores the contentious relationship between political ideologies and business aspirations. The argument that the process lacked impartiality raises serious implications for the integrity of regulatory mechanisms designed to oversee foreign investments.

CFIUS, chaired by the Treasury Secretary, typically exercises significant authority over foreign transactions involving American companies. In this specific instance, the committee’s inability to achieve consensus on the acquisition resulted in Biden independently blocking the deal, a decision that diverges from historical trends where acquisitions involving allies, like Japan, are rarely rejected.

Japanese Foreign Minister Takeshi Iwaya’s vocal discontent regarding the decision illustrates the precarious nature of international relations that can be influenced by domestic policy decisions. He has emphasized the importance of the U.S.-Japan alliance and urged American officials to address the business community’s concerns in light of the growing unease stemming from the acquisition debacle.

The delays have naturally generated speculation regarding the future of the U.S. steel industry and its global competitiveness. If the deal is ultimately allowed, Nippon Steel envisions a strategic partnership that could enhance operational efficiencies and secure a stronger foothold in the American market. However, if the acquisition continues to face obstacles, both companies will have to reassess their strategies in a landscape marked by increasing protectionism and scrutiny of foreign investments.

The ongoing discourse around the Nippon Steel and U.S. Steel merger reveals much more than the fate of a single acquisition; it offers a snapshot of a broader context where economic interests intersect with geopolitical considerations, labor dynamics, and national security. As the U.S. continues to navigate these turbulent waters, the implications for foreign investments could reverberate far beyond the steel sector, influencing future interactions with investors from allied nations and shaping the landscape of transnational business in a rapidly evolving world.

Leave a Reply