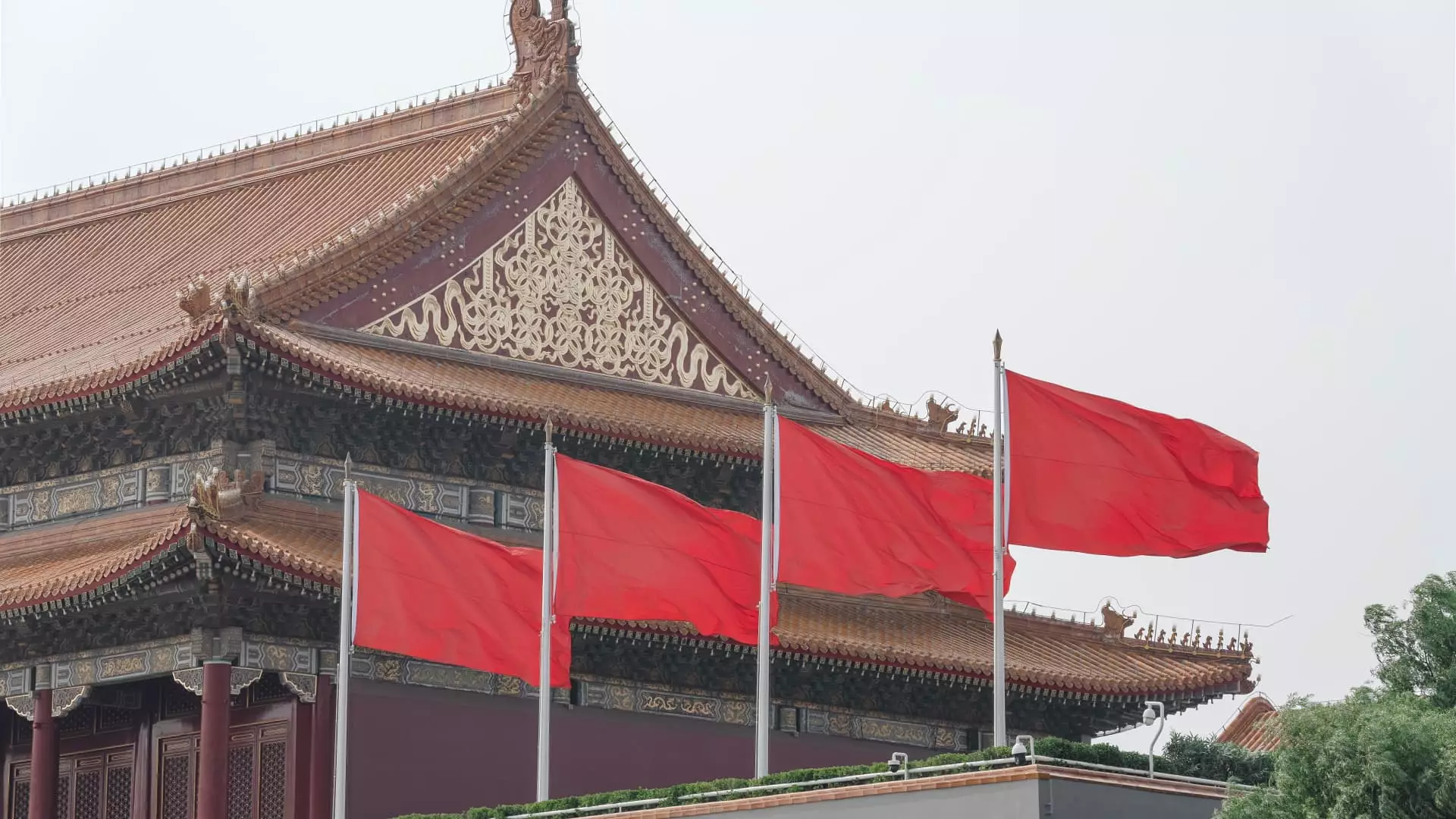

The recent performance of Asia-Pacific stock markets signals a striking recovery that mirrors the global economic landscape’s fluctuating nature. On Thursday, these markets experienced significant gains, bolstered by a wave of optimism and strategic economic maneuvers from major players like China. The rise in investor confidence is notably attributed to Beijing’s announcement of a series of economic stimulus initiatives aimed at invigorating growth within the region. Such proactive measures have encouraged both local and foreign investors to reassess their positions and engage with the markets, culminating in substantial upward movements across various indices.

The Chinese stock market stands out in this surge, particularly through the performance of the CSI 300 index, which represents a diverse cross-section of the Chinese economy. Over the past five days, the index has not only gained consistently but has also reached its highest levels in almost two months. This rally is a clear indicator of the positive sentiment surrounding China’s economic recovery efforts. Moreover, the Hang Seng index in Hong Kong has joined the upward trajectory, with futures suggesting a continuation of this promising trend. Such synchronized movements between the two markets underline the interconnectedness of economic activities within the region, raising hopes for sustained growth.

In Japan, the Nikkei 225 index showcased a notable climb of 1.7% during early trading, while the broader Topix index also witnessed a commendable increase of 1.2%. This rise can be partially attributed to the recent release of the Bank of Japan’s minutes from its July meeting, which may have allayed concerns regarding the direction of monetary policy. Investor sentiment appears bolstered by the anticipation of further supportive measures from the central bank, fueling optimism in the market. Similarly, South Korea’s Kospi index soared by 1.77%, with the small-cap Kosdaq not far behind at 1.51%. These figures are indicative of a general rebound in investor confidence across the Asia-Pacific region as nations work towards overcoming recent economic hurdles.

While Asia-Pacific markets thrive, the outlook in the United States painted a different picture overnight. Both the Dow Jones Industrial Average and the S&P 500 faced slight declines as they pulled back from recent record highs. Specifically, the S&P 500 slipped by 0.19%, while the Dow fell by 0.7%. This retreat may suggest a degree of market correction and illustrates a more cautious approach among U.S. investors in light of fluctuating economic indicators. Interestingly, the Nasdaq Composite managed to register a minimal increase of 0.04%, hinting that select sectors continue to attract investment despite the broader pullback.

The current landscape in the Asia-Pacific markets is a testament to the resilience of regional economies and their capacity for recovery. As economic forecasts evolve and government interventions take shape, the confidence demonstrated by investors in these markets suggests that a more robust growth trajectory may be on the horizon. Conversely, the challenges faced by the U.S. markets remind us of the complexities within the global economy and the vital importance of adaptability. Investors and analysts alike will be keenly observing these developments, as the interaction between these diverse economic environments could shape future strategies in a rapidly changing world.

Leave a Reply