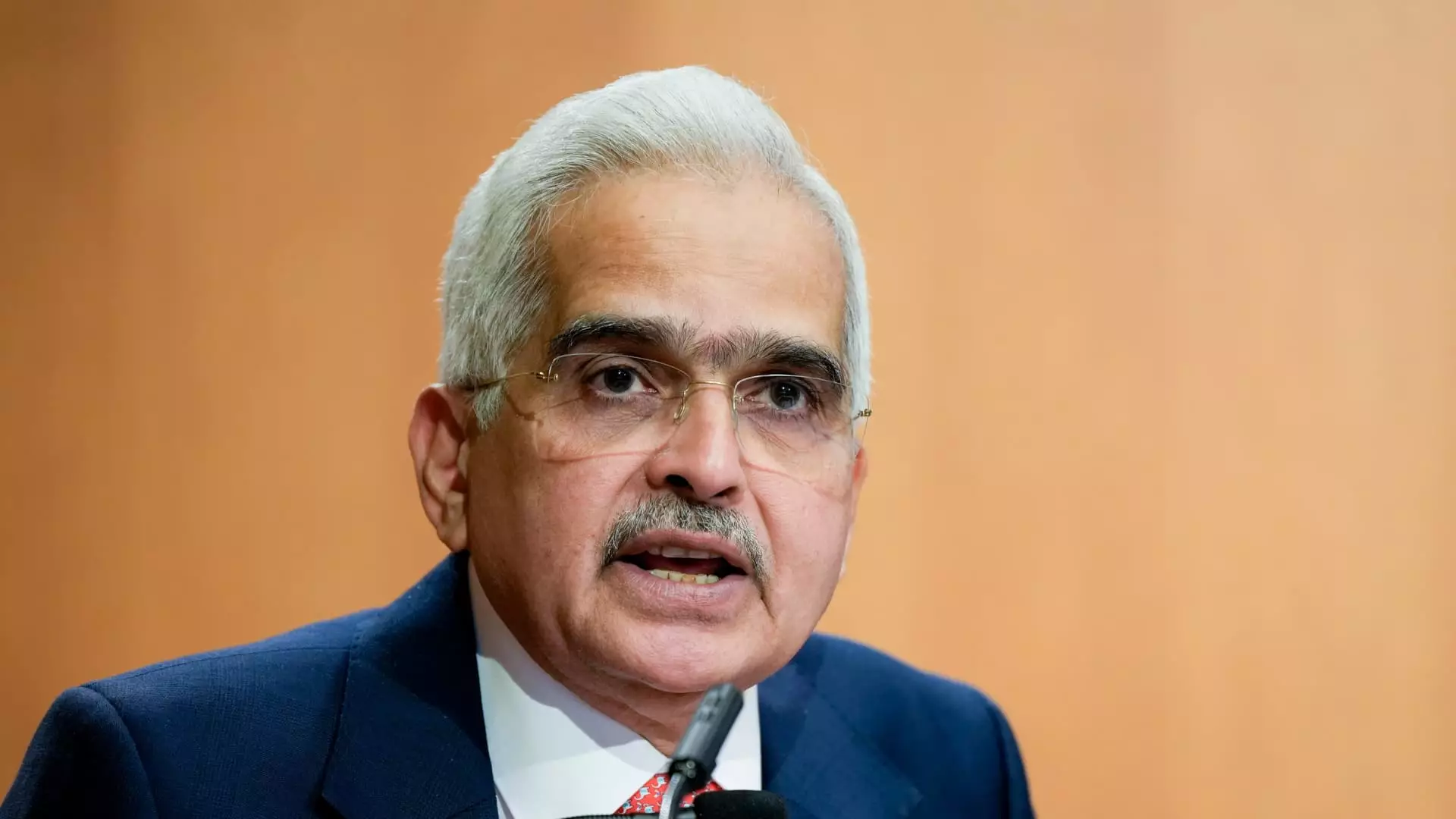

In a world marked by unpredictable financial shocks and a volatile geopolitical landscape, central banks have had to navigate a myriad of challenges. The Governor of the Reserve Bank of India (RBI), Shaktikanta Das, recently shed light on these dynamics at the CNBC-TV18 Global Leadership Summit in Mumbai. According to Das, despite the ongoing global risks including inflationary pressures and declining economic growth, central banks have effectively orchestrated a soft landing. This achievement reflects their adeptness in managing monetary policy amid external disruptions, which range from geopolitical tensions to climatic unpredictability.

Das expressed cautious optimism, noting that while the immediate turbulence seems to have been mitigated, the specter of inflation returning remains a pressing concern. The geopolitical conflicts, fluctuating commodity prices, and the continuing process of geoeconomic fragmentation contribute to an uncertain economic environment. This sums up the balancing act central banks must perform in order to maintain economic stability without stifling growth.

One of the complex issues highlighted by Das was the paradox in global financial markets, particularly the strength of the U.S. dollar juxtaposed against a backdrop of slashed interest rates by the Federal Reserve. The dollar index’s surprising rise amid interest rate cuts prompts questions about the underlying mechanics of global currency markets. It illustrates a scenario where traditional indicators no longer seem to dictate currency value as they once did. This reflects a broader trend of financial markets becoming increasingly influenced by manifold factors, including investor sentiment and geopolitical developments, rather than solely by monetary policy adjustments.

Moreover, Das pointed out the drastic divergence between gold and oil prices, noting how these two commodities, typically known to move in tandem, are currently exhibiting contrasting behaviors. Such discrepancies in price movements can confuse investors attempting to gauge market trends and economic direction. Understanding these complexities becomes essential for those participating in the marketplace, illustrating the need for sophisticated analyses that go beyond simplistic market metrics.

The resilience of financial markets in the face of escalating geopolitical instability presents a striking contrast noted by Das. While tensions have indeed intensified globally, markets have shown a unique persistence. The ongoing strife might lead some to predict market downturns; however, current stock performances contradict this narrative. This divergence calls for a more in-depth evaluation of market psychology and the underlying fundamentals that contribute to the perceived strength of markets even in challenging times.

In the context of global trade, which Das projects will continue to grow despite tariffs and import restrictions, the narrative becomes even more complex. Growth amid adversity illustrates not just resilience but also an adaptability that can be a hallmark of enduring economies.

Looking at India’s financial situation more closely, Das asserted that the Indian economy is navigating through these multifaceted challenges remarkably well. While the global context may encourage uncertainty, India’s growth trajectory reflects robustness. The RBI’s decision to maintain interest rates at 6.5% speaks to a careful strategy that aims to balance inflation control while supporting growth dynamics.

In a parallel session at the same summit, Indian Union Minister of Commerce Piyush Goyal advocated for more aggressive monetary policies, suggesting that a reduction in interest rates could amplify growth further. His assertion that India remains the fastest-growing economy feeds into the optimism surrounding its economic potential. Therefore, the calls for lenient monetary policies indicate a desire to capitalize on current growth while being mindful of looming inflation risks.

The remarks from Shaktikanta Das and Piyush Goyal provide vital insights into the current economic climate shaped by central banking strategies and geopolitical dynamics. As central banks work to ensure stability amid complex challenges, the interplay between monetary policy, market behavior, and global trade will continue to evolve. Policymakers must remain vigilant, balancing the delicate act of fostering growth while containing inflationary pressures. Only time will reveal if these strategies will yield sustainable economic progress or if new shocks will reshape the financial landscape once again.

Leave a Reply