As the trading day unfolds, investors have several significant updates to consider following a notable performance in the stock market. The S&P 500 achieved its fourth consecutive day of gains, ascending by 0.75%. Meanwhile, the Nasdaq Composite stood out with a 1% increase, largely driven by a resurgence in technology stocks. The Dow Jones Industrial Average also joined the upward trend, adding 235.06 points, amounting to a 0.58% rise. This favorable momentum is particularly timely as investors closely examine the producer price index (PPI), the last inflation report prior to the imminent Federal Reserve meeting. The PPI measures the average change in prices received by businesses for their goods and services. Recently released data indicated a 0.2% increase in wholesale prices for August, a figure that aligns with market expectations.

In a significant labor development, over 30,000 Boeing employees commenced a strike after they rejected a tentative contract agreement with the International Association of Machinists and Aerospace Workers (IAM). This work stoppage has crucial implications as it puts a halt to the production of Boeing’s leading aircraft models, thereby intensifying challenges for a company already grappling with various operational setbacks. IAM District 751 President, Jon Holden, described the strike as an “unfair labor practice strike,” reflecting deeper tensions between the workforce and management. Boeing has expressed a commitment to mending its relationship with both employees and the union, indicating readiness to resume negotiations. The consequences of this strike could reverberate throughout the aviation industry and may impact both production timelines and financial forecasts.

In the realm of technology and innovation, Adobe reported third-quarter results that surpassed Wall Street’s predictions concerning sales and earnings. However, despite this positive performance, shares plummeted by approximately 8% during premarket trading. The cause of the market reaction stems from the company’s cautious guidance for the fourth quarter, which fell below analyst expectations. Analysts anticipated earnings per share of $4.67 alongside sales of $5.61 billion; Adobe’s projections highlighted earnings of between $4.63 and $4.68 per share, with revenue estimates of $5.5 billion to $5.55 billion. On a brighter note, the company noted an impressive 11% year-on-year surge in subscription revenue for the quarter, underscoring the continued strength of its digital offering despite the tepid outlook.

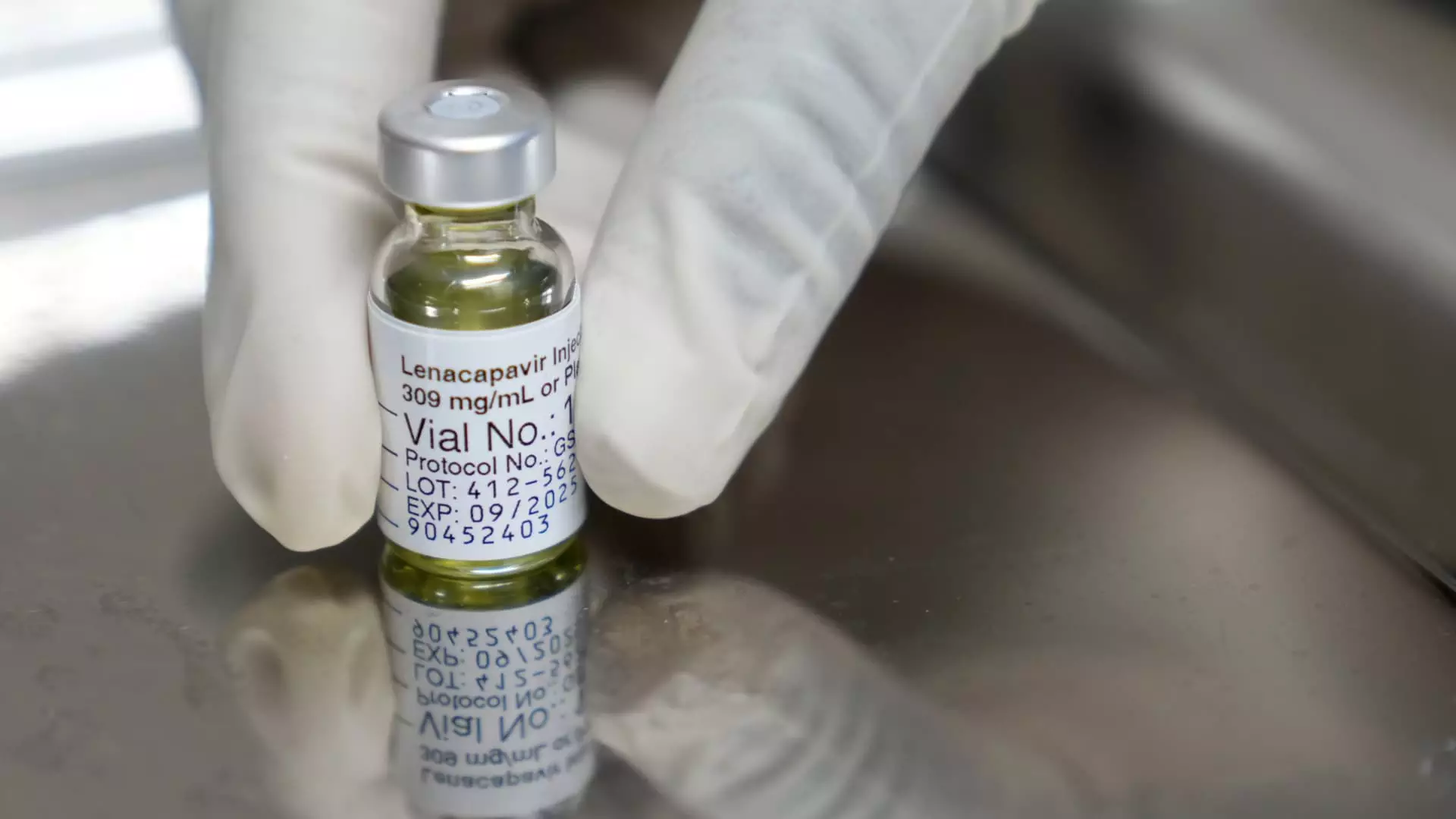

Turning to healthcare innovations, drug manufacturer Gilead announced a groundbreaking update from its trials involving a new HIV preventive treatment, lenacapavir, which has demonstrated an impressive 96% reduction in HIV infections. In a comprehensive Phase-III trial involving 2,180 participants, only two cases of HIV were recorded. This substantial efficacy rate opens avenues for the potential approval of lenacapavir by the U.S. Food and Drug Administration for use as an HIV preventive measure. Such advancements not only provide hope for those at high risk but also represent a significant step forward in the fight against HIV/AIDS, signaling a potential shift in treatment protocols.

Shifting focus to the fashion sector, a pivotal legal showdown is unfolding as Tapestry, the parent company of Coach, and Capri Holdings, owner of Michael Kors, engage in courtroom negotiations over their proposed $8.5 billion merger. Originally announced over a year ago, the merger has faced scrutiny from the Federal Trade Commission (FTC), which contended that the consolidation would diminish competition in the handbag market, potentially leading to higher prices and lower employee wages. The ongoing legal discourse is examining the competitive landscape surrounding the handbag industry, with both companies positing that the merger would enhance market conditions. The outcomes of these proceedings are likely to shape not only the companies involved but also broader market dynamics in the retail sector.

As trading commences, investors must navigate a complex landscape that includes economic indicators, significant labor movements, corporate earnings updates, medical breakthroughs, and major legal battles. Each of these elements has the potential to influence market sentiment and investor strategies in the days ahead.

Leave a Reply