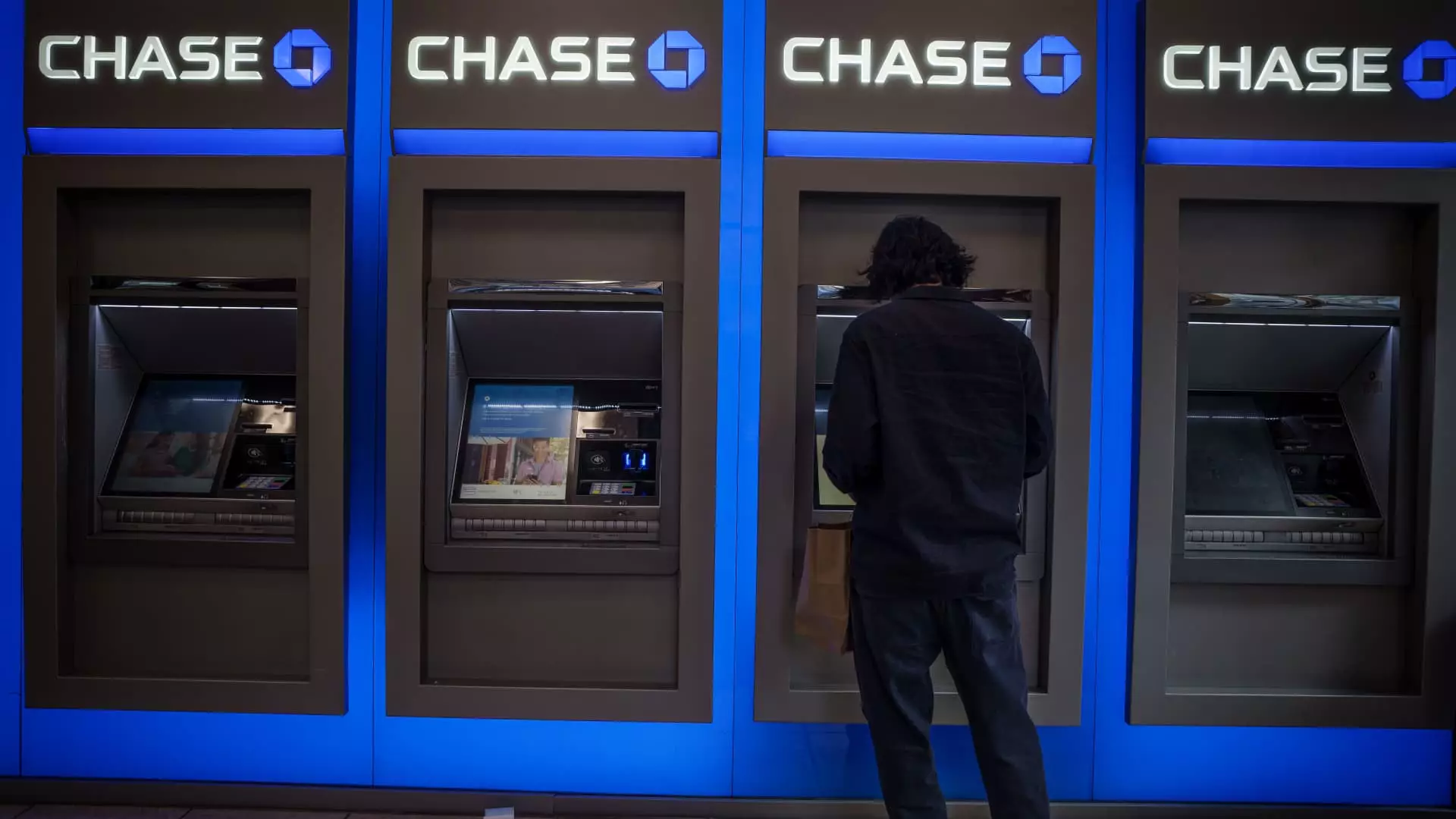

In recent months, a peculiar phenomenon known as the “infinite money glitch” has caught the attention of the public and financial institutions alike. This situation unfolded when several individuals exploited a loophole in JPMorgan Chase’s ATM system, which allowed users to withdraw funds before their checks cleared. The glitch came about as a result of a technical oversight, where the immediate availability of funds led to rampant ATM withdrawals, often originating from counterfeit checks. Social media platforms like TikTok played a significant role in amplifying this behavior, showcasing individuals celebrating their unexpected financial windfalls. This series of events set the stage for a legal showdown that would put the issue of digital payment vulnerabilities into the spotlight.

On Monday, JPMorgan Chase announced its intention to pursue legal action against individuals allegedly involved in exploiting this scheme, filing lawsuits across multiple federal courts. These cases include instances of significant financial misappropriation, with one notable example involving a man in Houston accused of transferring nearly $300,000 through fraudulent means. The stark reality is that these lawsuits are not mere punitive actions; they represent the bank’s commitment to safeguarding its financial integrity and client trust in a digital age.

The bank’s allegations highlight the calculated nature of these schemes, where individuals often colluded with accomplices to deposit counterfeit checks, subsequently draining their accounts before the bank could detect the fraud. Such coordinated acts not only endanger the financial institution but also threaten the entire banking ecosystem, which relies on trust and transparency.

Despite the increasing prevalence of digital transactions, checks remain vulnerable to fraud. The Global Financial Crime Report cites a staggering $26.6 billion in losses due to check fraud globally in the past year alone. This reality underscores the necessity of ongoing vigilance in a banking culture that is rapidly evolving but still retains its roots in traditional practices like check writing and cash withdrawals. The incidents arising from the infinite money glitch serve as a critical reminder that vulnerabilities can be exploited, irrespective of technological advancements.

In addition to the immediate legal ramifications, JPMorgan’s response extends to a broader examination of its policies and security measures. The bank claims to have closed the loophole that facilitated these fraudulent activities shortly after the incidents began gaining traction. However, the long-term implications of this incident may compel the institution to reevaluate its operational protocols surrounding check deposits and ATM withdrawals, ensuring that similar issues do not arise in the future.

These lawsuits serve a dual purpose: seeking financial restitution and reinforcing a message of zero tolerance towards fraud. With knowledge of the incidents now public, it is likely that JPMorgan’s actions may deter others from attempting similar scams, recognizing the potential legal consequences they face.

The bank’s strategy appears to focus on targeting those responsible for the highest dollar amounts, particularly where there may be suspected links to organized crime. This strategic approach aims to signal to potential fraudsters the serious nature of their actions and the repercussions they could face. Given that JPMorgan has also referred various cases to law enforcement, there is an indication that the effort to combat fraud will be both civil and criminal in nature.

The linkage to social media, however, is critical. Platforms like TikTok can rapidly disseminate knowledge of financial loopholes, escalating their exploitation. Therefore, financial institutions must not only tighten their internal structures but also engage in educational efforts to warn the public against participating in such schemes. A strong collaborative relationship between banks, law enforcement, and education platforms is essential in creating a more secure financial environment.

As JPMorgan Chase embarks on this legal journey, the implications of the infinite money glitch remind us all of the importance of maintaining vigilance in an increasingly digital and interconnected financial world. Banks must adapt to new challenges while reinforcing trust through transparency, security, and proactive measures against fraud. The evolution of banking practices necessitates ongoing dialogue about vulnerabilities and the societal responsibilities of both financial institutions and consumers in safeguarding the integrity of our economic systems.

Leave a Reply