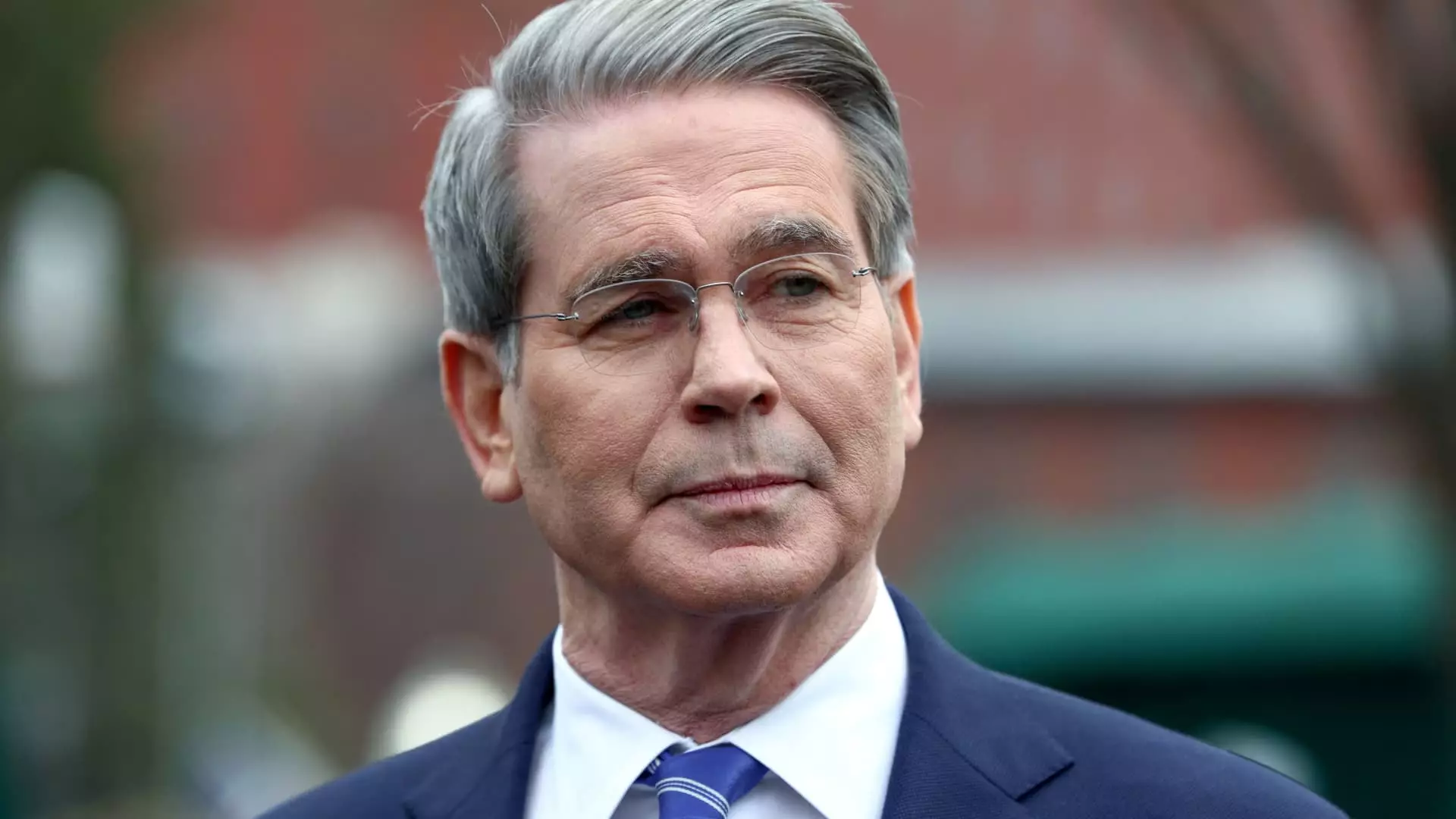

In a recent display of unyielding optimism, Treasury Secretary Scott Bessent exudes confidence in the Trump administration’s economic policies, characterizing impending recession fears as a mere “false narrative.” However, such assurances sharply contrast with reality. The very fabric of American financial stability is under siege, and it is painfully disheartening to see leaders dismiss palpable anxiety among citizens—especially those nearing retirement, whose livelihoods may hang precariously on market fluctuations. The day-to-day volatility of the stock market does matter to those who have painstakingly saved for years, hoping to secure a financially stable future. The idea that such individuals can ignore recent downturns, as Bessent suggests, is an astonishing oversimplification of a complex reality.

Rugged Optimism Versus Real-World Impact

Bessent argues that Americans tend to have a long-term perspective on investments, yet he overlooks a critical point: the very foundation of retirement savings is often built upon trust in consistent market performance. When the stock market experiences significant declines—particularly in times of heightened uncertainty—the future of many savings accounts becomes shrouded in doubt. The reality is that retirement plans aren’t just abstract concepts; they represent real lives, faces, and families who are now shuddering at the thought of their dwindling financial nest eggs. The cavalier attitude displayed by Bessent feels disconcerting and disconnected; it trivializes the emotional and financial strain faced by those preparing to step into retirement.

Tariffs: A Gamble with Economic Consequences

Bessent’s unwavering support for Trump’s tariff strategy evokes a sense of incredulity as he dismisses the recent stock market nosedive as temporary turbulence rather than a harbinger of deeper systemic issues. Tariffs—especially when wielded as go-to tools for economic growth—are fraught with uncertainty and risk. The assertion that these aggressive trade policies will fortify our economic foundations is speculative at best. Tariffs may indeed redistribute wealth and jobs, but at what cost? American consumers ultimately bear the brunt of higher prices and an uncertain job market, which contradicts the notion of a thriving economy for the average citizen.

Moreover, the references to historical figures like Ronald Reagan serve only to romanticize an era that should not be blindly idolized, as every economic climate has its idiosyncrasies. Drawing parallels between current economic challenges and Reagan’s policies might resonate as nostalgic rhetoric to some, but marshalling historical examples does not substantiate an appeal for confidence in policies that are, in nature, vastly different from those of the past.

Long-Term Fundamentals or Short-Sighted Strategies?

While Bessent touts the Trump administration’s commitment to rebuilding America’s economic infrastructure, it’s critical to challenge the narrative of long-term success against the grim backdrop of an economic crisis. As they repeatedly emphasize adjusting tariffs to inflation, one must reflect on whether we are cultivating sustainable economic growth or merely stitching up the proverbial wounds inflicted by volatility in a global market.

The claim that partners in trade have “taken advantage of us” might resonate for some, but it carries an undertone of irresponsibility, ignoring the multifaceted complexities of international economics. Blame-shifting does nothing to empower America to resolve its financial inconsistencies. Instead of finding enemies overseas, the administration should be focusing on collaborating with allies to foster shared prosperity and balance our financial ecosystem.

The Challenge of Economic Recovery

Bessent’s rhetoric about “Investment in America” and the boasts of economic recovery stand starkly against the uncertainty thousands feel today. The purported revolution in business and job creation may exist too, but the tangible benefits for everyday Americans remain uncertain. Until we see equitable job growth and a more balanced approach to economic policy, such declarations will ring hollow.

As the country navigates this rocky economic landscape, leaders should acknowledge the fears and realities faced by the American people. Flat-out denial of market anxieties only serves to deepen mistrust and widen the gap between citizens and their government. If we are to build a better future, silence must give way to genuine dialogue rooted in shared experiences, allowing for nuanced approaches rather than brash proclamations. The stakes are too high for anything less.

Leave a Reply