Philadelphia Federal Reserve President Patrick Harker recently expressed his support for an interest rate cut in September, signaling a strong likelihood of monetary policy easing in the near future. Harker emphasized the importance of initiating a gradual rate reduction process and providing clear signals well in advance to the market. Despite the market’s anticipation of a 25 basis point cut, Harker remains uncertain about the magnitude of the adjustment, stating that he needs to evaluate more data before making a decision.

Market Expectations and Policy Challenges

Market expectations reflect a high certainty of an interest rate cut, with a notable probability of a 50 basis point reduction. The Federal Reserve has maintained its benchmark borrowing rate for several years to combat inflationary pressures. Despite initial resistance from officials about the necessity of rate cuts, there is growing acknowledgment within the Fed that easing will soon be warranted. This shift in policy direction is driven by concerns about inflation and labor market resilience.

Independence from Political Considerations

Harker emphasized the Fed’s commitment to making policy decisions based on data and economic indicators rather than political motivations. As the upcoming presidential election looms, central bank officials view themselves as impartial technocrats focused on maintaining economic stability. Harker’s stance underscores the importance of data-driven decision-making in determining the appropriate timing and magnitude of interest rate adjustments.

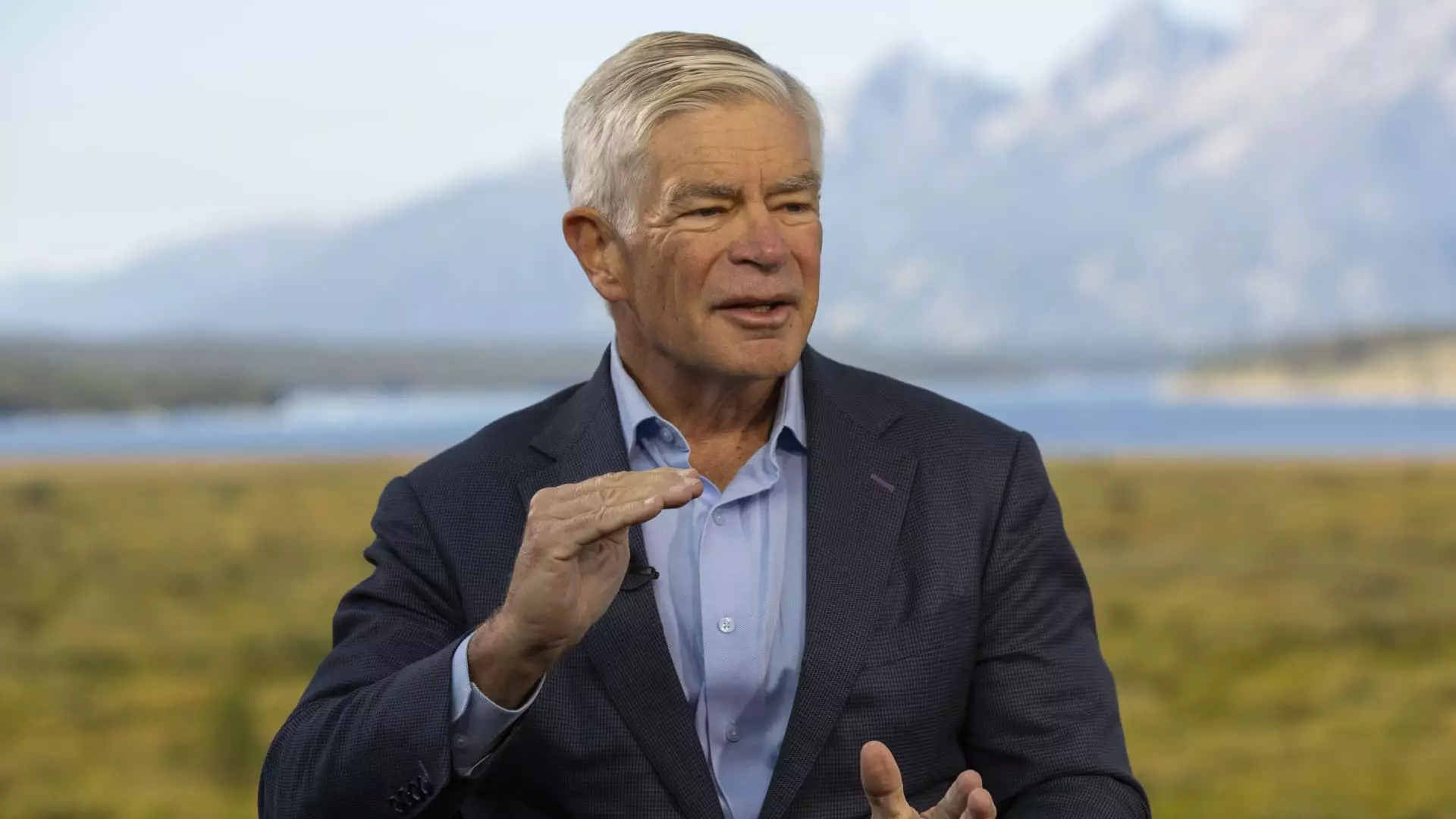

Kansas City Fed President Jeffrey Schmid echoed Harker’s sentiments about the need for a potential rate cut, citing concerns about rising unemployment rates and labor market imbalances. The labor market’s role in shaping inflation dynamics cannot be overlooked, as supply-demand disparities have contributed to wage increases and inflation expectations. While recent data suggest a moderation in job indicators and an uptick in unemployment rates, further scrutiny is required to assess the labor market’s trajectory.

Looking ahead, the Federal Open Market Committee’s deliberations on interest rates will be crucial in shaping the economic landscape. While Harker and Schmid provide valuable insights into the rationale for potential rate cuts, the ultimate decision lies with the committee’s collective judgment. As policymakers navigate the complexities of inflation, employment trends, and overall economic conditions, it is essential to strike a balance between stimulating growth and preserving financial stability.

The debate surrounding interest rate adjustments reflects the Federal Reserve’s ongoing efforts to adapt to evolving economic conditions. The forthcoming decisions on monetary policy will have far-reaching implications for the broader economy and financial markets. By carefully assessing data and considering various factors, central bank officials aim to foster sustainable economic growth while mitigating risks of downturns. The path ahead underscores the importance of informed decision-making and proactive measures to support a resilient and robust economic environment.

Leave a Reply