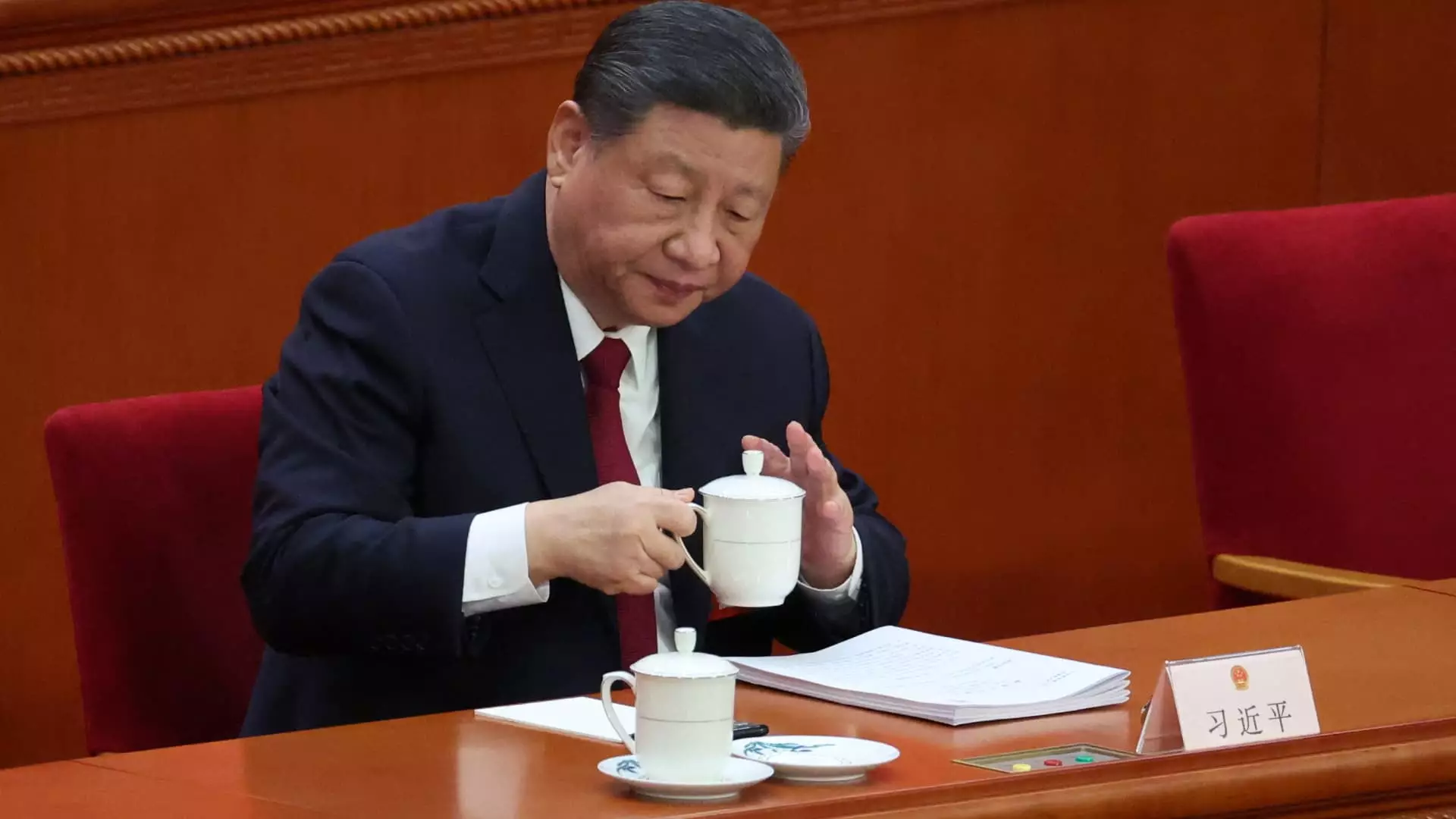

In the face of rising geopolitical tensions and sluggish growth forecasts, the recent measures announced by China to bolster struggling businesses expose a deeper malaise within the country’s economy. President Xi Jinping’s recent meeting with the Politburo—a crucial political apparatus—signaled an urgency to address the overwhelming pressures arising from external shocks, predominantly rooted in the escalating trade conflict with the United States. The imposition of tit-for-tat tariffs has sparked much anxiety among investors, reflecting a broader concern that the Chinese economy is navigating treacherous waters.

As major financial institutions reassess their forecasts, projecting a troubling slowdown in GDP growth—witnessing a decline toward the 5% target initially set earlier in the year—it becomes clear that China’s economic pillars are at risk of collapse without immediate and effective intervention. While the rhetoric from Beijing promises financial support for shoring up distressed businesses, one can’t help but question whether these measures will bring about substantial relief, or if they are merely a band-aid on a gaping wound.

Targeted Measures: An Uncertain Lifeline

The measures laid out by the Politburo, then, seem both necessary and superficial. A focus on financial support and timely reductions in interest rates and reserve requirements does address imminent liquidity concerns for businesses struggling to maintain their foothold. Yet, the vagueness surrounding these measures raises eyebrows regarding their effectiveness. The commitment to explore the specific needs of businesses amid trade turmoil is commendable, yet it bears an unsettling hallmark of the bureaucratic tendency towards indecision and procrastination.

Policymakers, while signaling flexibility in responding to market conditions, appear hesitant to enact a robust stimulus package. In an economy requiring swift and decisive action, such indecisiveness can sow the seeds of doubt among businesses, large and small alike. As the Finance Minister suggests an increased fiscal deficit limit, there is a glaring disparity between the need for urgent action and the reluctance to pivot towards a more aggressive monetary policy stance.

Shift Towards Domestic Consumption

A noteworthy shift in focus is the emphasis on enhancing the income of middle and lower-income populations, which could have far-reaching implications for consumer behavior in the face of global trade disruptions. By supporting domestic consumption, the Chinese government aims to insulate its economy from the prevailing external shocks and lessen reliance on exports—a strategy that seems both prudent and necessary as international markets become increasingly volatile.

However, the question remains: Can China really enhance domestic consumption while simultaneously grappling with the psychological weight of uncertainty? Innovating to integrate artificial intelligence in services could play a pivotal role in creating a more flexible and responsive market, yet this development requires investment and a cultural shift that may take time to materialize.

The Balancing Act of Policy Directive

Ultimately, the recent meeting of the Politburo highlights a critical balancing act. On one hand, there is an acknowledgment of the need for swift action in response to international pressure; on the other, a commitment to cautious progression underscores a classic case of reformists versus conservatives within the Chinese Communist Party. As leaders call for broad policy directives without much in the way of groundbreaking initiatives, the potential for real, transformative change remains dim.

China’s response to these challenges will likely shape not just its immediate economic strategies, but also its long-term positioning on the global stage. The forthcoming National People’s Congress meetings will present an opportunity for policymakers to introduce legislation aimed at nurturing the private sector’s growth. However, the extent to which this will translate into tangible benefits for struggling businesses remains to be seen, especially when history suggests a propensity for bureaucratic inertia over bold reform.

As the world’s second-largest economy grapples with these multifaceted challenges, it stands at a crossroads—between maintaining its authoritarian grip on governance and adjusting to an unpredictable global economy. This pivotal moment may dictate whether China sustains its trajectory of growth or succumbs to the adversities it face.

Leave a Reply