Nvidia’s recent slip from the exclusive $3 trillion market valuation club has left Apple standing alone as a formidable force in the tech landscape. Following a disheartening quarterly earnings report, Nvidia’s stock plummeted by over 8%, erasing approximately $273 billion in value and bringing its market capitalization down to $2.94 trillion. The tech sector, reflected by significant losses in indices such as the S&P 500 and Nasdaq—both down by 1.6% and 2.8%, respectively—underscores a broader trend of volatility in the market.

Despite its current valuation, Nvidia has faced considerable scrutiny from investors in recent months. A notable 10% depreciation in share value since the start of 2025 reflects overarching concerns about export controls, tariffs, and the advent of more efficient artificial intelligence models. The vagaries of growth rates have prompted investors to reassess the sustainability of Nvidia’s extraordinary rise, particularly since the company was riding high at the onset of the generative AI boom two years ago.

Yet, amid this downward trajectory, Nvidia can still boast significant gains from its historic valuation. The company’s current worth is five times its value from just two years ago when it initially ascended to a $3 trillion market cap back in June 2024. This resilience indicates that despite the downturn, Nvidia continues to be a formidable player, largely driven by the surging adoption of AI technologies.

Nvidia’s recent earnings report, while impressive on the surface—with revenue soaring by 78% year-over-year to $39.33 billion—still prompts questions about long-term sustainability. The company’s data center revenue, which encompasses its cutting-edge graphics processors for AI, grew a staggering 93% annually, reaching nearly $36 billion. Such figures are undoubtedly robust, yet they come with caveats regarding external economic conditions and investor confidence in future growth trajectories.

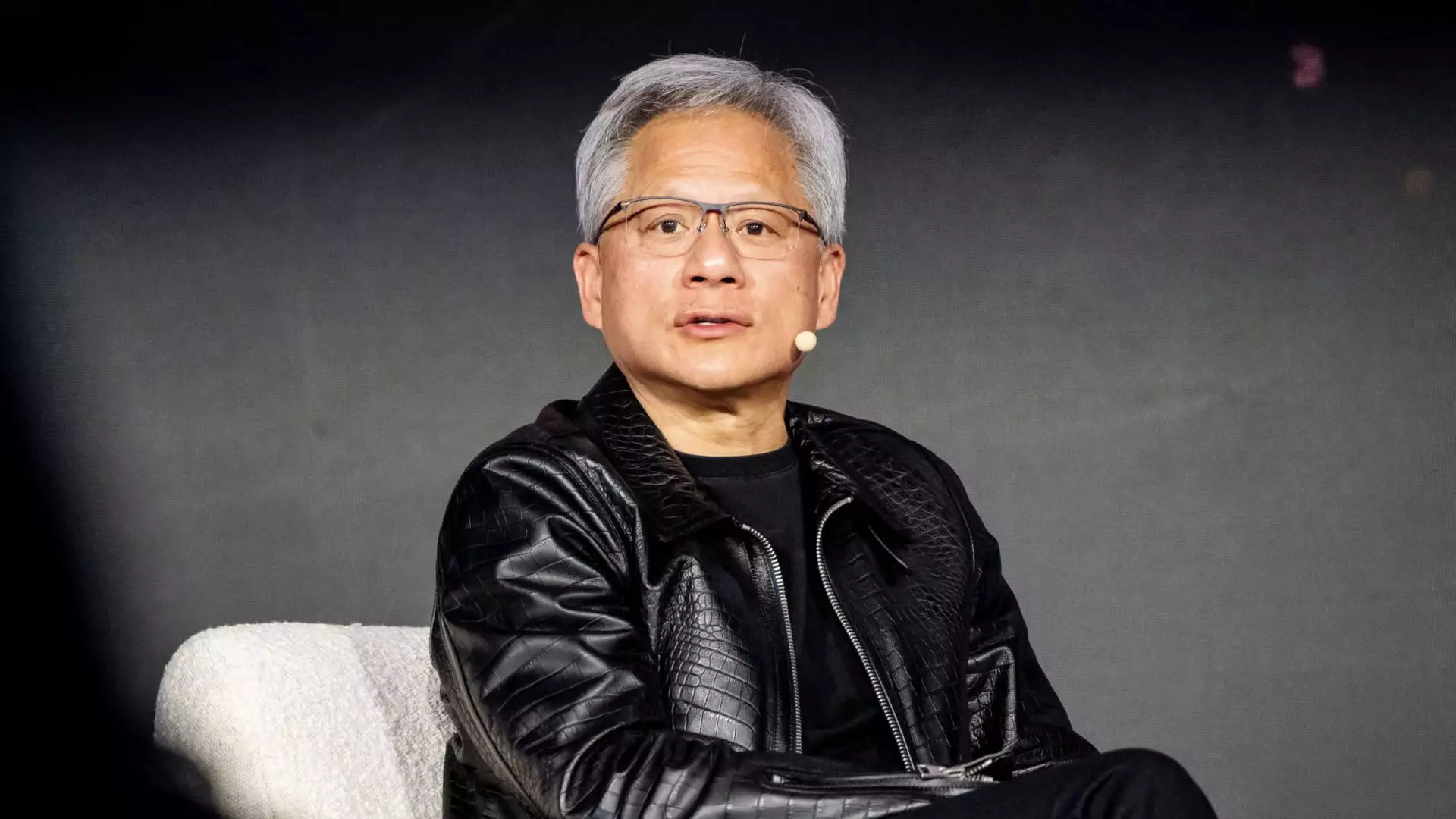

CEO Jensen Huang’s optimistic remarks on the strong demand for chips signal a proactive strategy aimed at navigating these challenges. He emphasized the increasing computational requirements of next-generation AI models, which necessitate vastly more processing power. This revelation positions Nvidia as essential for major tech firms, as it underscores its investment in infrastructure critical for maintaining an edge in AI development.

As we examine Nvidia’s standing in the tech market, one cannot overlook the crucial role played by its relationships with key cloud service providers like Microsoft, Google, and Amazon. These partnerships, which form the backbone of Nvidia’s revenue model, suggest that while the company is grappling with short-term earnings volatility, its strategic position remains strong in the face of rising demand for AI technologies.

Nvidia’s recent fall from the prestigious $3 trillion valuation is a reflection of both market dynamics and evolving investor sentiments. Although the company faces significant challenges amid the economic headwinds and competitive pressures, it continues to demonstrate resilience and potential for growth in a burgeoning AI-driven market. The need for robust performance will depend on how efficiently Nvidia can leverage its technological capabilities to meet the insatiable demands of an increasingly digital and AI-centric economy.

Leave a Reply