The semiconductor industry continues to demonstrate resilience and growth, exemplified by Foxconn’s impressive fourth-quarter earnings report. As the global landscape for technology and artificial intelligence evolves, the ripple effects of such milestones are felt throughout the broader industry. Analyzing the implications of Foxconn’s record performance, we gain insights into not just the current state of the semiconductor market, but also the future trajectories likely to shape its dynamics.

Foxconn, known globally as Hon Hai Precision Industry, recently unveiled a staggering revenue figure of 2.1 trillion New Taiwan dollars (approximately $63.9 billion) for the fourth quarter, marking a remarkable 15% increase from the previous year. This achievement is not merely a reflection of seasonal trends but underscores a robust demand for cloud and networking products, including artificial intelligence servers—an area that’s been heavily influenced by advancements from leading chip manufacturers like Nvidia. The dual thrust of skyrocketing demand in AI and the gradual normalization in other product segments presents a complex but optimistic picture for stakeholders.

Interestingly, despite Foxconn’s overall revenue surge, the company indicated a slight decline in its computing products and smart consumer electronics segments, notably in the smartphone market. This nuanced revelation suggests that while the AI boom is strong, other traditional markets are experiencing challenges, potentially signaling a shift in consumer behavior or market saturation.

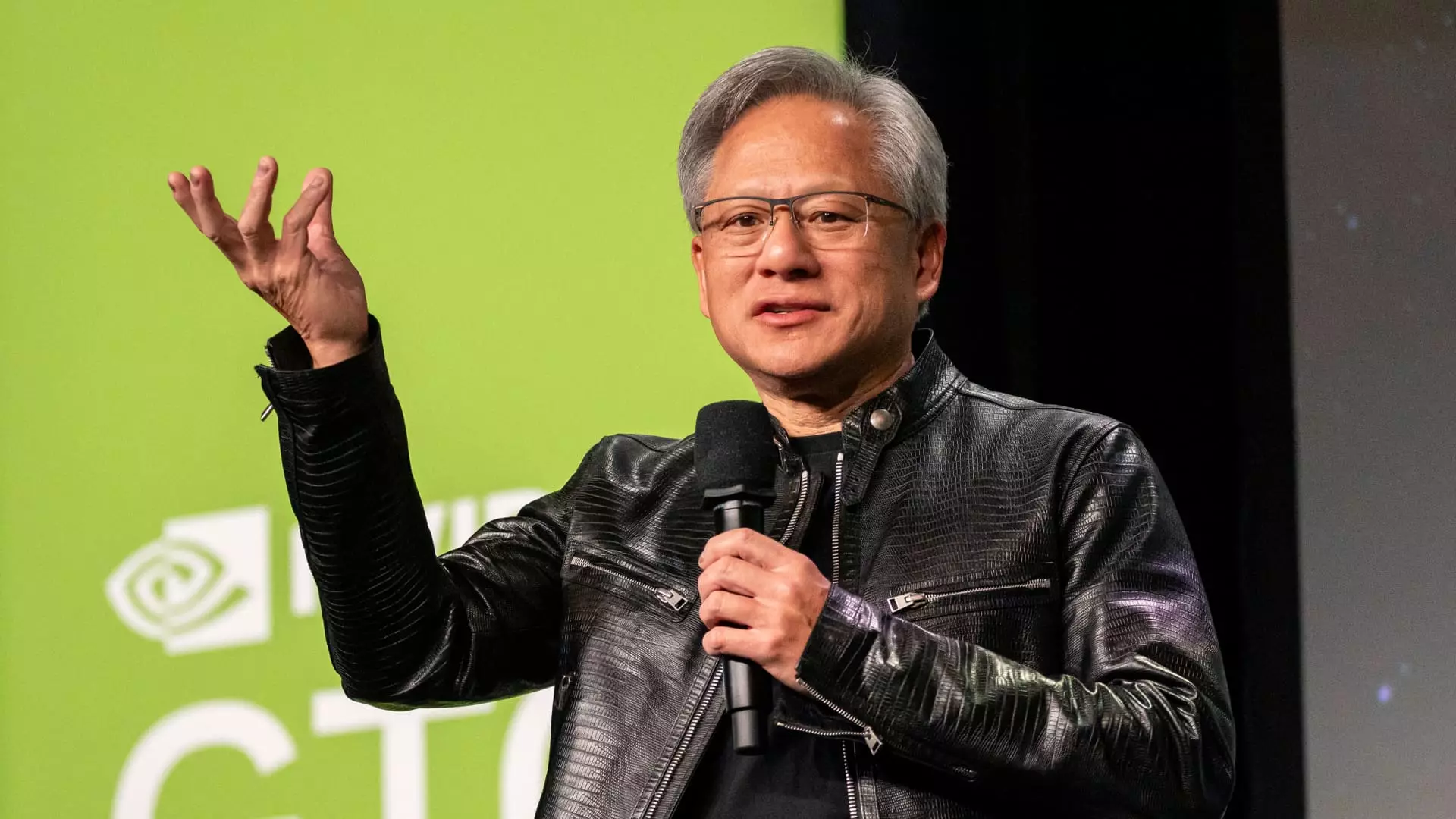

The consequences of Foxconn’s record revenue were immediate and widespread across the semiconductor industry. In the U.S., stocks from titans like Nvidia surged, closing up over 3%. The timing of CEO Jensen Huang’s keynote at the 2025 Consumer Electronics Show provided an additional catalyst for market optimism, shining a spotlight on Nvidia’s pivotal role in AI and further enhancing investor confidence.

Furthermore, the recent announcement from Microsoft to invest $80 billion on data center enhancements to manage AI workloads has invigorated the industry. Such significant investment from one of the world’s leading tech firms is likely to escalate demand for GPUs, which are essential for running advanced AI algorithms. Other semiconductor companies, captured within this wave of optimism, saw their stock prices soar. AMD, Qualcomm, and Broadcom also reported notable gains, reflective of a sector-wide confidence in future growth trajectories.

The momentum was palpable not just in the U.S. but also in Asia and Europe, showcasing a truly global bullish sentiment in semiconductor stocks. Taiwan Semiconductor Manufacturing Co. (TSMC) reached record price highs, driven by its central role in chip production for major clients like Advanced Micro Devices and Nvidia. In South Korea, companies like SK Hynix and Samsung also observed significant stock increases, achieving close to 10% and 4%, respectively.

Meanwhile, European players were similarly buoyed, with ASML and ASMI reporting substantial gain percentages—8.7% and 6.2% respectively. The strong performance of these companies indicates a robust demand for semiconductor equipment and technology, positioning them favorably amidst increasing investments in AI technology across multiple sectors.

Reflecting on the substantial happenings within the semiconductor industry, it is evident that the surging demand for AI technology and applications is reshaping the landscape. Companies like Foxconn, Nvidia, AMD, and TSMC not only play critical roles in advancing technology but also capture the essence of a rapidly evolving market marked by innovation. The interplay between traditional markets and emergent technologies suggests that while some sectors may be facing challenges, the opportunity lies overwhelmingly in AI and related technologies.

The coming years will likely witness a renewed focus on enhancing technological capabilities, driven by both consumer demand and corporate investments. As companies adapt to these trends, the semiconductor industry stands poised for significant growth, all while navigating the complexities of a shifting global economy. For investors and stakeholders, the insights triggered by Foxconn’s record performance illustrate both the potency and the unpredictability of a market caught in a dynamic era of rapid technological advancement.

Leave a Reply